Introduction

The topic of bank interest rates in Canada is increasingly relevant as they directly affect consumers’ financial decisions and the broader economy. Understanding these rates helps Canadians navigate savings, loans, and other financial products. As of 2023, numerous factors have influenced interest rate adjustments, which can impact everything from mortgage payments to student loans.

Current Bank Interest Rates

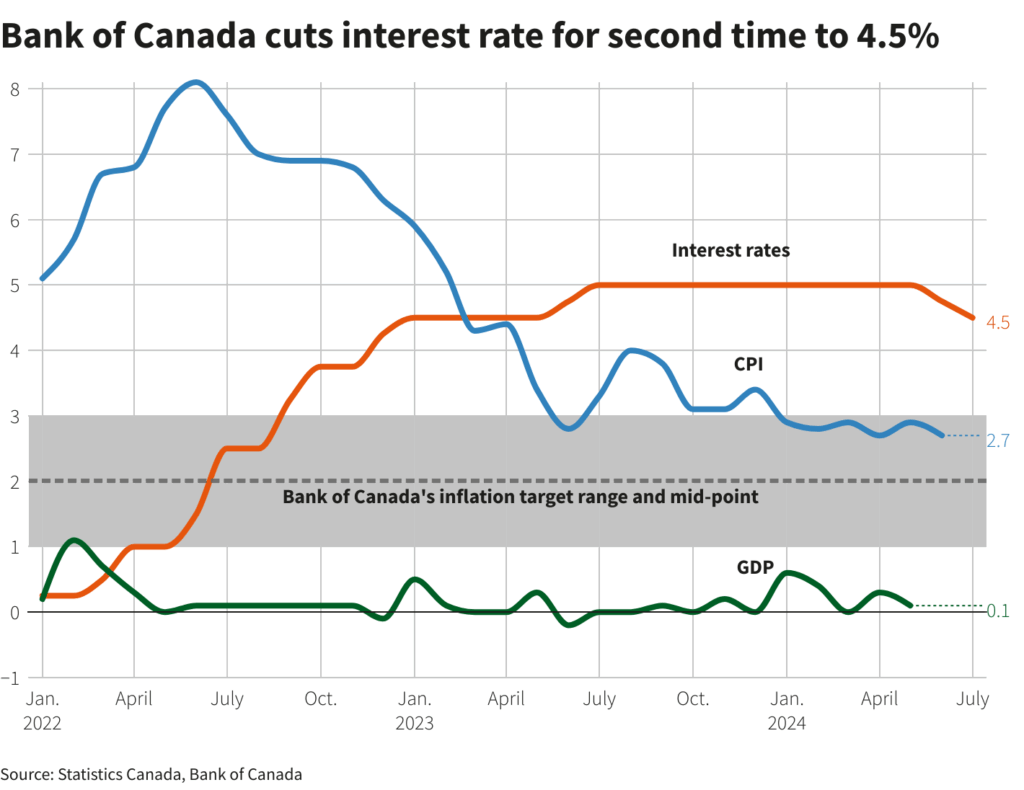

The Bank of Canada, the country’s central bank, announced a significant increase in its benchmark interest rate to 5.0% in August 2023. This figure marks a notable rise from previous years due to ongoing inflationary pressures. Interest on savings accounts has also seen slight increases, now averaging between 1.5% to 2.5 %, depending on the financial institution. These rates present both challenges and opportunities for Canadian consumers.

Impact of Interest Rate Changes

As interest rates rise, borrowing costs increase. This affects anyone looking to obtain a mortgage, personal loan, or revamp credit. For example, an increase in mortgage interest rates can result in higher monthly payments, potentially reducing home affordability. On the contrary, higher interest rates also benefit savers, who can earn more from their savings accounts and fixed deposits.

Reactions and Predictions

Financial experts share mixed sentiments regarding future rate changes. While some predict that the Bank of Canada might maintain higher rates for the rest of 2023 to combat inflation, others believe that a potential decline could occur if the inflation rates stabilize and economic growth slows. The Canadian economy is finely poised, and the decisions made by the Bank of Canada will significantly influence individual financial planning and overall economic growth.

Conclusion

Understanding Canada bank interest rates is crucial for consumers in 2023, given the current economic climate. As rates evolve, individuals must stay informed about existing financial products and consider how ongoing changes could affect their spending and saving habits. Awareness of the economic landscape and interest rate trends is vital for making informed financial decisions now and in the future.