Introduction

As the banking landscape rapidly evolves towards digital solutions, EQ Bank has emerged as a significant player in Canada’s financial services sector. This completely online bank, a subsidiary of Equitable Bank, is not only making waves with its no-fee structure and competitive interest rates but also challenging traditional banking norms. The relevance of digital banking has been amplified in recent times, especially amid the increased demand for accessible and convenient banking solutions in the wake of the COVID-19 pandemic.

Key Features of EQ Bank

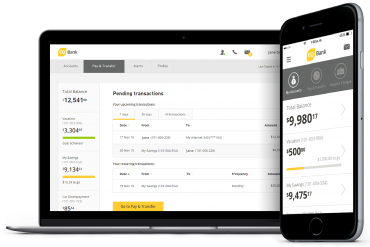

Launched in 2016, EQ Bank distinguishes itself through an innovative product suite tailored for the modern consumer. Its core offerings include high-interest savings accounts with rates that consistently outpace traditional banks. Customers can expect no monthly fees, no minimum balances, and easy access to their funds through a user-friendly app and website.

Furthermore, EQ Bank provides a seamless digital experience, featuring instant fund transfers and transaction alerts. A standout feature is the bank’s EQ Bank Savings Plus Account, which combines the benefits of a savings account with the flexibility of a chequing account, allowing users to earn interest while having easy access to their money.

Recent Developments

In recent months, EQ Bank has continued to enhance its offerings, launching new features such as its TFSA and RRSP accounts, aligning with Canadian customers’ financial planning needs. As of October 2023, the bank has reported a significant increase in customer acquisition, citing a growing preference for online banking solutions.

Moreover, EQ Bank is committed to maintaining high standards of security and customer service. Continuous updates to its platform keep customers informed of their transaction security, ensuring peace of mind in the digital realm.

Conclusion

The rise of digital banking is undeniable, and EQ Bank is at the forefront of this revolution in Canada. Its no-frills, customer-friendly approach is set to attract a broader audience, particularly younger generations seeking efficient banking solutions without the hassles of traditional banking. As EQ Bank continues to innovate and expand its services, it represents a shift in the way Canadians manage their finances. Future forecasts suggest that with increasing digital literacy and technological advancements, online banking providers like EQ Bank will continue to thrive and reshape the financial landscape in the years to come.