Introduction

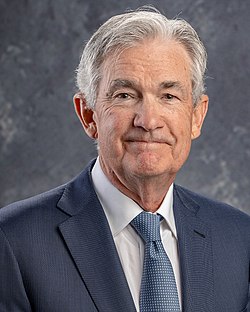

Jerome Powell, the Chair of the U.S. Federal Reserve, plays a pivotal role in shaping the monetary policy of the United States. His decisions not only influence the American economy but also have significant ramifications globally. As inflation rates fluctuate and economic recovery remains a pressing issue, understanding Powell’s strategies becomes essential for investors, policymakers, and the general public.

Current Economic Context

Recent reports show that inflation in the U.S. has reached levels not seen in decades, creating challenges for maintaining economic stability. In response, Powell has emphasized the Federal Reserve’s commitment to controlling inflation through strategic interest rate adjustments. The Fed’s decisions are closely monitored as they impact borrowing costs, consumer spending, and overall economic growth.

Powell’s Recent Announcements

During the latest Federal Open Market Committee (FOMC) meeting, Powell indicated that while the economy shows signs of resilience, caution is necessary. He stated that the Fed plans to continue raising interest rates as needed to combat persistent inflation, which is currently above the target rate of 2%. Analysts and economists are predicting further rate hikes in the coming months as the Fed aims to stabilize prices.

Market Reactions

The stock market’s reaction to Powell’s announcements has been mixed. While some sectors face pressure due to rising borrowing costs, others, particularly in the financial industry, see potential for growth with higher interest rates. Investors are adapting to this new economic strategy with a focus on sectors that can thrive in a higher interest rate environment.

Future Outlook

Looking forward, Powell’s leadership will significantly influence how monetary policy evolves in response to changing economic conditions. Analysts suggest that maintaining a delicate balance between curbing inflation and supporting economic growth will be critical. Market watchers are also aware that geopolitical factors, including supply chain disruptions and energy prices, could further complicate the economic landscape.

Conclusion

Jerome Powell’s role as Chair of the Federal Reserve has profound implications for both the U.S. and global economy. As he navigates the challenges of inflation and economic recovery, Powell’s decisions will be pivotal in shaping the future of economic policy. Individuals and businesses alike should stay informed about his actions and the Federal Reserve’s strategies, as they will directly impact financial markets and everyday economic conditions.