Introduction

The retirement age in Canada is a crucial topic that resonates with many Canadians, especially as they approach the end of their working lives. With increasing life expectancy and changing economic conditions, the conversation surrounding the official retirement age has become more relevant than ever. Understanding the retirement age can help Canadians plan their finances, lifestyle, and retirement goals effectively.

Current Retirement Age and Government Regulations

As of now, the official retirement age in Canada is considered to be 65 years, when individuals can start receiving their Old Age Security (OAS) pension. However, Canadians also have the option to defer their OAS benefit until they turn 70, which can increase the monthly payments significantly. The Canada Pension Plan (CPP) allows for retirement as early as 60, with reduced benefits, and individuals can also choose to receive CPP at 65 for full benefits or defer until 70 to see an increase in the amount received.

Changing Trends in Retirement Planning

The trend towards an earlier retirement age has been observed in recent years. Studies indicate that many Canadians are opting to retire as soon as they can access their pensions. Factors influencing this trend include physical health, job satisfaction, and financial preparedness. A report from Statistics Canada found that approximately 50% of Canadians retire before the age of 65. Moreover, changes in the workforce, including remote work and more flexible job options, allow for a more individualized approach to retirement planning.

Economic Considerations

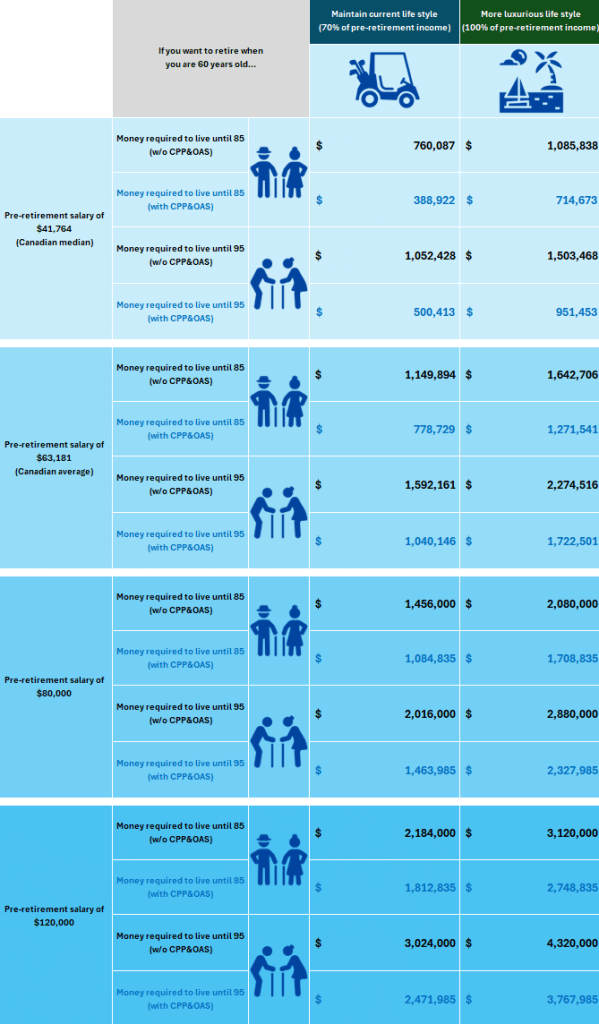

The economic landscape also plays a significant role in shaping retirement ages. The rising cost of living, coupled with inflation rates, has made the need for adequate retirement savings increasingly apparent. Financial advisors suggest that Canadians should plan for a retirement that may last 20-30 years, necessitating careful financial planning and savings strategies. Additionally, many Canadians are re-entering the workforce post-retirement for various reasons, including a desire to remain mentally and physically active or to supplement their pensions.

Conclusion

Canada’s retirement age and its implications are multifaceted, reflecting a mix of personal choice, economic pressures, and policy regulations. As individuals navigate their retirement planning, understanding the options available is vital. It is expected that conversations around retirement age may continue evolving as demographics shift and economic conditions change. Canadians are encouraged to stay informed and proactive about their retirement strategies to ensure a comfortable and fulfilling retirement.