Introduction: The Significance of the Dow Jones

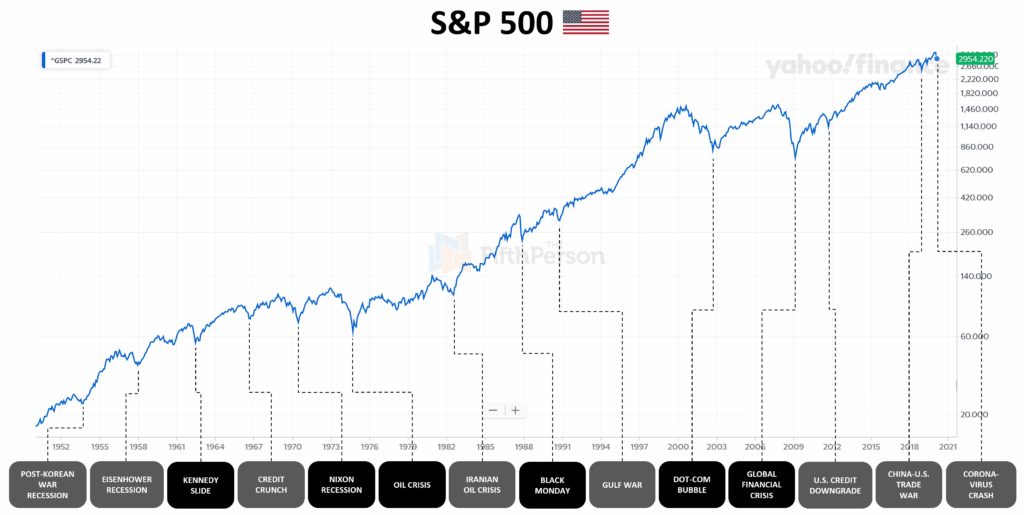

The Dow Jones Industrial Average (DJIA) is one of the most widely recognized stock market indices in the world, encompassing 30 major U.S. companies. As a barometer of economic health, it reflects investor confidence and market trends, making it an essential focus for investors and analysts alike. Recent fluctuations in the Dow have garnered significant attention, as they may indicate broader economic shifts that could impact markets globally, including Canada.

Current Trends in the Dow Jones Stock Markets

As of October 2023, the Dow Jones has exhibited notable volatility, influenced by multiple factors including inflation rates, interest rate hikes by the Federal Reserve, and geopolitical tensions. In the past month, the index has fluctuated between highs and lows, showcasing the ongoing uncertainty amid an attempt to stabilize post-pandemic growth. Key sectors contributing to these fluctuations include technology, healthcare, and energy. Notably, tech stocks have seen both surges and declines in recent trading sessions, reflecting investor sentiment towards future earnings amid a tightening monetary policy.

Factors Affecting the Dow

The economic backdrop remains turbulent due to high inflation leading to increased interest rates. Analysts predict that these conditions could persist, potentially leading to a prolonged period of instability in stock markets. Recent reports from the U.S. Labor Department indicate inflation rates remain stubbornly high at 4.2%, prompting the Fed to maintain a cautious stance. Investors are closely monitoring these developments to gauge their effects on stock prices. Globally, geopolitical issues such as rising tensions in Eastern Europe and the implications of China’s economic slowdown further compound the uncertainty in the Dow.

Conclusion: Future Outlook for Investors

Looking ahead, experts suggest that while the short-term outlook for the Dow Jones faces risks, a potential market rebound could occur if inflation rates begin to stabilize and investors regain confidence. For Canadian investors, understanding trends in the Dow is crucial, as these can influence market conditions in Canada, particularly in sectors closely tied to U.S. economic performance. As always, diversification and a strategic approach to investment remain essential in navigating these volatile times. Investors are encouraged to stay informed and consider both domestic and international economic indicators as they make decisions moving forward.