The Importance of Interest Rates in Canada

Interest rates play a crucial role in shaping the Canadian economy. They influence borrowing costs for consumers and businesses, impacting everything from mortgage rates to loan agreements. Understanding the current interest rate landscape in Canada is essential for making informed financial decisions, especially as the Bank of Canada takes measures to manage inflation and stimulate growth.

Current Interest Rate Environment

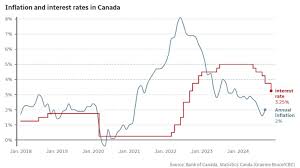

As of October 2023, the Bank of Canada has maintained its key interest rate at 5.0% following a series of hikes earlier in the year aimed at curbing inflation. This decision came after observing a slight cooling in inflation rates, which had surged past the Bank’s target of 2%. The higher interest rates reflect the ongoing efforts to stabilize the economy while ensuring consumer prices remain manageable. The most recent inflation figures indicate a year-over-year rate of 3.4%, a decrease from earlier peaks, suggesting the Bank’s measures may be starting to have the desired effect.

Impact on Borrowing and Spending

With interest rates at their current level, consumers can expect increased costs on variable-rate loans, including mortgages and personal loans. Economists warn that this could lead to a slowdown in consumer spending as individuals and families grapple with tighter budgets. For prospective homebuyers, high interest rates can deter purchasing decisions, leading to a deceleration in the housing market. According to the Canadian Real Estate Association, home sales have already begun to reflect these market challenges, seeing a significant drop compared to the previous year.

Looking Ahead: Future Predictions

Many experts predict that interest rates may remain stable for the next few months as the Bank of Canada assesses the ongoing economic effects of its current policy. However, various external factors, including global economic trends, supply chain dynamics, and geopolitical issues, may influence future interest rate decisions. Economists at major financial institutions suggest that if inflation trends continue to moderate, the Bank may opt for a slight reduction in rates by mid-2024 to encourage economic growth post-pandemic.

Conclusion

In summary, the current interest rates in Canada serve as a pivotal element in the financial landscape of the country. As consumers navigate higher borrowing costs, understanding the implications of these rates is essential. The actions of the Bank of Canada will be crucial in shaping future economic conditions. Readers should stay informed on interest rate trends to make sound financial decisions moving forward.