Introduction

UnitedHealth Group Incorporated, listed under the ticker symbol UNH, is a major player in the health insurance and healthcare services sector. As one of the largest companies in the industry, its stock performance is closely monitored by investors and analysts alike. Understanding the dynamics of UNH stock is crucial not only for investors but also for those interested in the broader healthcare market, particularly in light of ongoing changes in healthcare policy and economic conditions.

Current Market Performance

As of October 2023, UNH stock has shown resilience amidst market fluctuations. After experiencing a dip in early 2023, the stock has regained momentum and is trading around $500 per share. This recovery can be attributed to several factors, including strong earnings reports and strategic acquisitions that have bolstered UnitedHealth’s market position.

Earnings and Financials

The latest quarterly earnings report, released in September 2023, indicated that UnitedHealth had surpassed Wall Street expectations, reporting earnings of $6.15 per share compared to the anticipated $5.90. The company also increased its full-year guidance, projecting revenue growth of approximately 12% year-over-year, further instilling confidence among investors. These positive financial indicators have contributed to a recent surge in UNH stock price.

Future Projections and Analyst Opinions

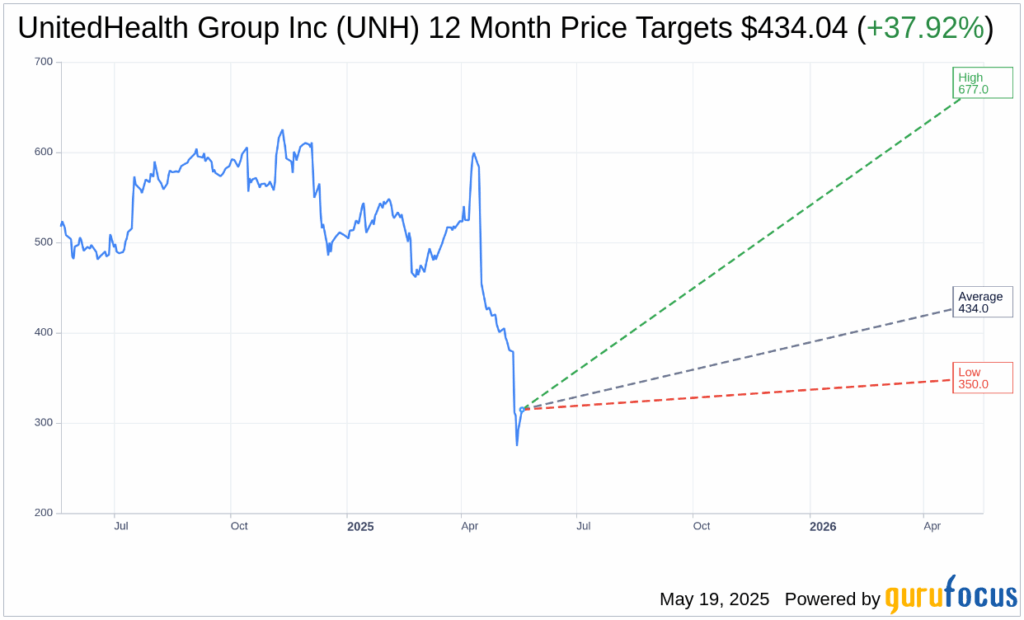

Forward-looking analysts maintain a cautiously optimistic view on UNH stock. Many analysts have rated it as a ‘Buy,’ with price targets projected between $520 and $560 over the next 12 months. The anticipated growth is supported by UnitedHealth’s strategic initiatives to expand its services and improve patient outcomes, particularly with the introduction of telehealth services which have seen increased demand post-pandemic.

Conclusion

The performance of UNH stock remains a vital indicator of the health insurance industry’s overall trajectory. As UnitedHealth continues to adapt to market changes and consumer needs, investors should monitor updates within the healthcare sector and potential regulatory impacts. With a favorable outlook and increasing investment in healthcare technologies, UNH stock could present opportunities for both short and long-term investors looking to capitalize on one of the most stable sectors in the market.