Introduction

PayPal Holdings, Inc. has long been a key player in the digital payments industry, providing services to consumers and businesses alike. As its stock performance continues to attract investor attention, understanding the current trends and factors influencing PayPal stocks is vital for both investors and market analysts. With the rise of e-commerce and digital transactions, the relevance of PayPal in the financial sector has never been greater, making it imperative for stakeholders to stay informed about stock dynamics.

Recent Performance and Market Trends

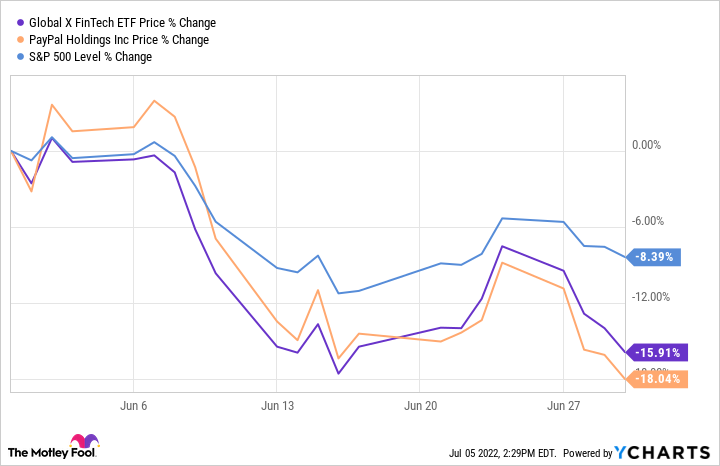

As of October 2023, PayPal’s stock (NASDAQ: PYPL) has experienced noticeable fluctuations. After reaching an all-time high in mid-2021, the stock saw a significant decline due to various macroeconomic factors, including rising interest rates and inflation concerns, which have affected tech stocks broadly. In the last quarter, however, PayPal’s shares have started to recover slightly, driven by a resurgence in online shopping and digital adoption, particularly in emerging markets.

According to recent trends, PayPal’s stock rose by approximately 15% over the past month, buoyed by positive earnings reports and strategic initiatives to enhance its offerings. The company has announced expansions to its platform, including partnerships with major retailers and improvements in payment processing technology to stay competitive in the fast-evolving digital payments landscape.

Future Outlook and Industry Significance

Analysts remain cautiously optimistic about PayPal’s future. Expectations are that as economic conditions stabilize, consumer spending on digital platforms will sustain growth for companies like PayPal. Analysts project that the company may benefit from an increase in transaction volume as more consumers continue to shift from cash to digital payments, further solidifying its market position.

Moreover, PayPal has been expanding its services beyond payments, including the introduction of cryptocurrency transactions and buy-now-pay-later options, which cater to diverse consumer needs. This diversification may enhance its marketability and attract a broader customer base.

Conclusion

In summary, while PayPal stock has faced challenges recently, current trends suggest a potential recovery aided by strategic initiatives and enhancements in service offerings. For investors, closely monitoring PayPal’s performance, industry movements, and macroeconomic indicators will be crucial in making informed investment decisions. With its established position in the digital payment sector, PayPal is poised for significant developments that could shape its stock performance in the forthcoming months.