Introduction

The stock of IonQ, a leading quantum computing company, has captured the attention of investors in the rapidly evolving tech sector. With quantum computing set to transform industries from pharmaceuticals to finance, understanding the dynamics behind IonQ’s stock is crucial for investors seeking opportunities in the market. The company’s innovative technology and partnerships with major corporations underline its potential, making it a focal point in the quest for advanced computational power.

Current Trends and Developments

IonQ has recently reported significant developments as it continues to advance its quantum technology. In September 2023, the company announced a partnership with a Fortune 500 firm, aiming to enhance cloud-based quantum computing services. The collaboration is expected to familiarize businesses with quantum technology’s potential while providing IonQ with increased market visibility.

Moreover, IonQ’s stock received a boost following its successful quarterly earnings report, published in August 2023. The report revealed that IonQ had surpassed analysts’ expectations, showcasing a 25% revenue increase compared to the previous year. Analysts credit this growth to the rising demand for quantum computing solutions and the increased adoption of IonQ’s systems in various industries.

Market Performance

Since its merger with dMY Technology Group in late 2021, IonQ’s stock performance has been volatile, reflecting broader market trends and the sentiment towards tech stocks. As of late October 2023, IonQ’s stock is trading at approximately $10.50 per share, slightly down from its peak of $17 in early 2022. Despite the fluctuations, market experts believe that IonQ’s position as a pioneer in quantum computing technology could lead to significant long-term gains.

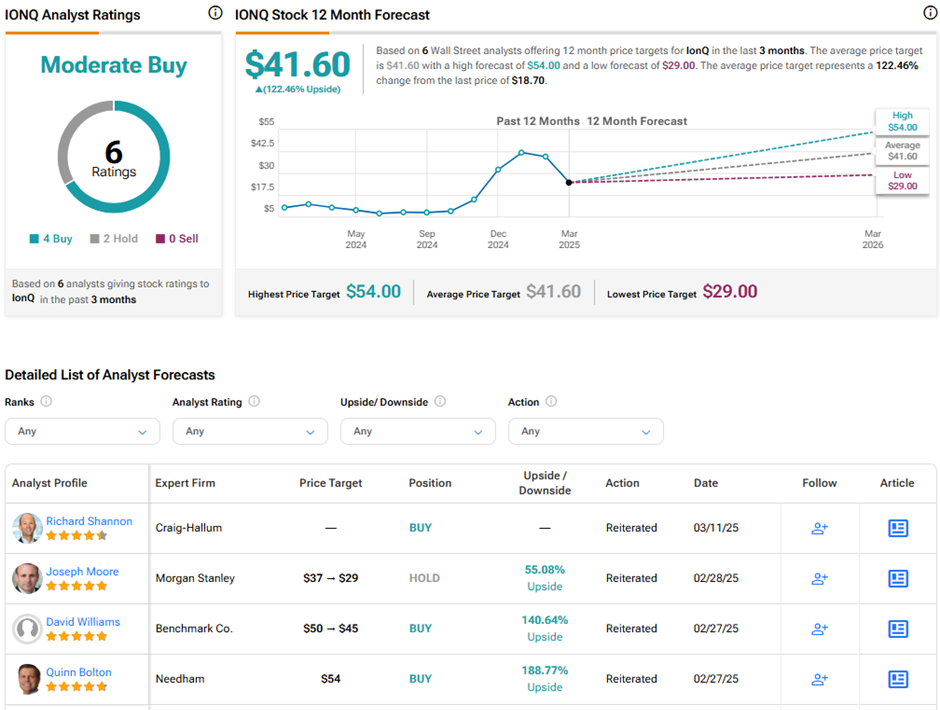

Future Forecasts

Looking ahead, industry analysts remain optimistic about IonQ’s prospects. Emerging applications of quantum computing in fields such as drug discovery, material sciences, and machine learning are expected to drive growth. The company’s strategy to expand its quantum circuits and increase qubit counts positions it favorably to meet the growing demands of the market.

Conclusion

In conclusion, IonQ stock represents an intriguing investment opportunity in the technology sector, particularly for those interested in the future of computing. With its innovative developments, strategic partnerships, and promising market forecasts, IonQ could well be at the forefront of a technological revolution. For potential investors, keeping a close watch on its trajectory will be essential as quantum computing begins to play a more pivotal role in various industries.