Introduction to GOOG Stock

The performance of Google’s parent company, Alphabet Inc., commonly represented by the stock symbol GOOG, plays a significant role in the technology sector and the broader market. With the rapid advancements in artificial intelligence, digital advertising, and cloud computing, GOOG stock has gained increased attention from investors and analysts alike. Understanding the current trends around GOOG is crucial for stakeholders as it reflects the company’s financial health and future potential.

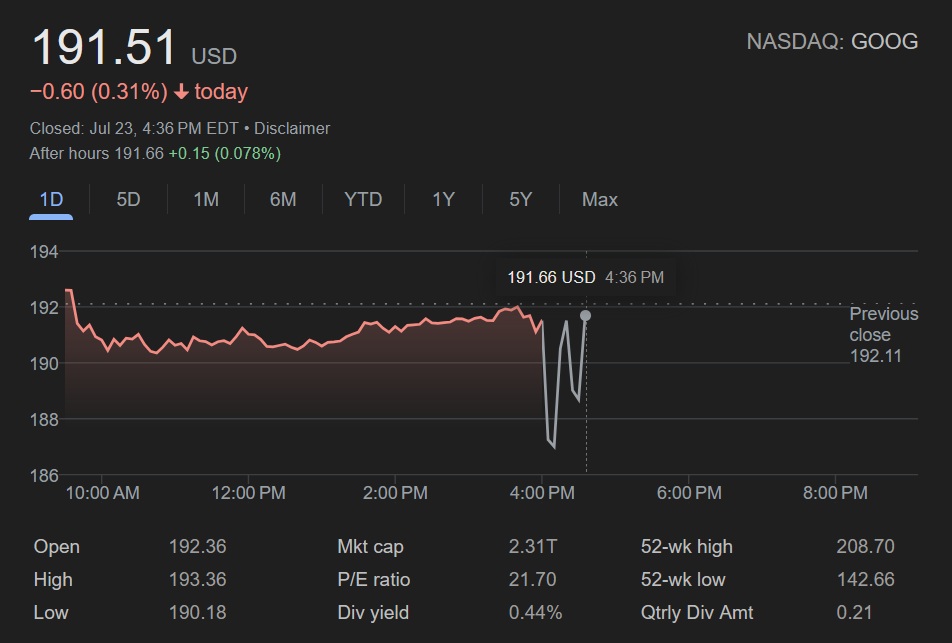

Recent Developments in GOOG Stock

As of October 2023, GOOG stock has shown a fluctuating yet upward trend, largely driven by robust earnings reports and strategic investments in new technologies. In its latest quarterly earnings report, Alphabet reported a revenue growth of 11% year-over-year, surpassing analyst expectations. This growth has been attributed to the rising demand for digital advertising and the successful expansion of Google Cloud services. Furthermore, the company’s ventures into AI, particularly through its Bard chatbot, have positioned it favorably amidst growing competition from companies like Microsoft and OpenAI.

In recent months, GOOG stock has faced some challenges, including regulatory scrutiny over privacy and antitrust issues. However, analysts remain optimistic, noting that Alphabet’s diverse revenue streams and constant innovation provide a cushion against market volatilities. In addition, market analysts have raised their price targets for GOOG stock, reflecting confidence in its long-term growth potential.

Market Impact and Future Outlook

The stock market has responded positively to these developments, with GOOG stock seeing a noticeable uptick in trading volume. This responsiveness highlights investor interest in tech stocks amid a rapidly-changing market environment. The average price target for GOOG stock currently stands at approximately $145, with some analysts suggesting it could reach as high as $160 in the coming year, barring any significant market disruptions.

Conclusion

In conclusion, GOOG stock represents a compelling investment opportunity, fueled by strong quarterly performances and innovative advancements in technology. As Alphabet continues to innovate and expand its services, investors will keep a close eye on how these factors influence stock performance. Potential investors should consider the balance of growth against regulatory risks, while existing shareholders might find reassurance in the company’s strong financial footing and future growth trajectory. Overall, the outlook for GOOG stock remains positive as it navigates through industry challenges and seizes emerging opportunities.