Introduction

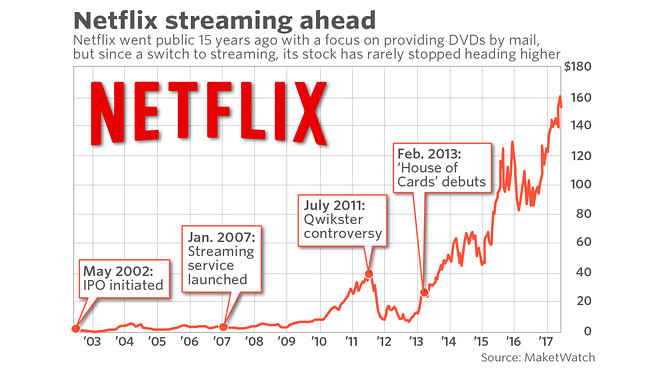

As an industry leader in streaming entertainment, Netflix’s stock (NASDAQ: NFLX) is a vital indicator of market trends in media and technology. Investors and analysts closely monitor its performance, making it a focal point for discussions on market innovation and consumer preferences. Recently, various factors have impacted Netflix’s stock price, including subscriber growth, competition, and economic fluctuations, making it essential for stakeholders to remain informed about its trajectory.

Current Stock Performance

As of October 2023, Netflix’s stock has shown significant fluctuations influenced by multiple factors. Over the past year, the stock price has oscillated between $170 and $500, reflecting both a robust recovery following the pandemic and subsequent pressures from increased competition and market saturation. Notably, Netflix celebrated a resurgence earlier this year, hitting a high of $425 per share in April, driven by a surge in global subscriptions and the release of highly anticipated original content.

Key Factors Influencing Netflix Stock

One of the primary factors affecting Netflix’s stock performance is its subscriber growth. The company announced a net addition of 10.3 million subscribers in the second quarter of 2023, which exceeded market expectations. This growth is particularly notable given the stiff competition from other streaming services like Disney+, Amazon Prime Video, and newly launched platforms.

Conversely, the introduction of password-sharing restrictions and increased subscription prices has led to concerns about potential subscriber loss. Financial analysts are divided on the long-term impact of these measures, with some forecasting a short-term dip in users while others predict it will lead to increased revenue per user.

Market Competition and Strategy

Competition is a constant in the streaming landscape, with platforms continuously investing in original content and technology. Netflix has responded by increasing its budget for original programming to $17 billion in 2023, a strategy aimed at attracting and retaining subscribers. The continued success of popular series and films remains crucial for Netflix’s stock valuation, as consumer interest significantly influences financial forecasts.

Conclusion

In conclusion, Netflix’s stock remains a critical barometer for the streaming industry, reflecting broader consumer trends and strategic business responses. AsNetflix ventures into new markets and adapts its pricing strategies, investors must keep a close watch on its subscriber metrics and competitive positioning. While challenges linger, such as rising production costs and increasing competition, Netflix’s ability to innovate and deliver quality content will be pivotal in sustaining its growth trajectory. In the near future, continued analysis of subscriber trends, market shifts, and Netflix’s evolving strategies will be essential for understanding the potential directions of its stock price.