Introduction

Canada’s inflation rate has become a critical topic amid recent economic challenges. As prices have surged across various sectors, understanding the reasons behind inflation and its ongoing impact is crucial for consumers, businesses, and policymakers alike. With inflation affecting everything from grocery bills to housing costs, its relevance to everyday Canadians cannot be overstated.

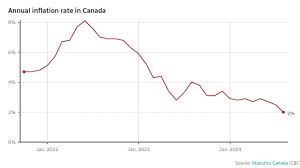

Current Inflation Rates and Trends

As of September 2023, Canada’s inflation rate stood at approximately 3.4%, a slight decrease from earlier months, according to Statistics Canada. The decline can be attributed to lower energy prices and decreased demand in certain sectors. However, costs in food and housing remain persistently high, placing considerable strain on households.

The Bank of Canada has maintained a cautious approach, with recent interest rate adjustments aimed at curbing inflation without stalling economic growth. Governor Tiff Macklem highlighted the delicate balance needed to support the economy while keeping inflation in check, stating, “Inflation is still above our target, which means we have more work to do.” The need for vigilance in monitoring inflationary pressures is evident as supply chain disruptions and geopolitical tensions continue to impact global markets.

Implications for Canadian Consumers

For Canadian consumers, the implications of inflation are profound. Many are feeling the pinch in their wallets, as everyday goods become more expensive. A recent survey indicated that over 60% of Canadians expressed concern about their ability to afford necessary expenses in the coming months. Moreover, food prices have surged by more than 6% year-over-year, leading many families to adjust their budgets significantly.

The government has responded with various initiatives aimed at supporting lower-income families and enhancing subsidies for essential services. However, experts warn that long-term solutions are necessary to address the root causes of inflation and ensure economic stability.

Conclusion

In conclusion, the current state of inflation in Canada represents a pressing challenge that requires attention from all sectors of society. While recent trends show a potential softening in overall inflation rates, the impact on consumers remains significant, especially concerning food and housing costs. As Canada navigates these economic hurdles, ongoing monitoring and strategic policy implementations will be essential to safeguard the financial well-being of Canadians. Moving forward, a cooperative approach among policymakers, businesses, and citizens will be crucial to mitigate the effects of inflation and foster sustainable economic growth.