Introduction

Walmart Inc., one of the largest retail corporations in the world, continues to be a focal point for investors. As of October 2023, Walmart’s stock performance is under scrutiny, particularly with ongoing changes in retail dynamics, inflationary pressures, and shifts in consumer spending. Understanding Walmart’s stock trends is essential not only for investors but also for analysts monitoring the broader economic landscape in North America.

Recent Performance

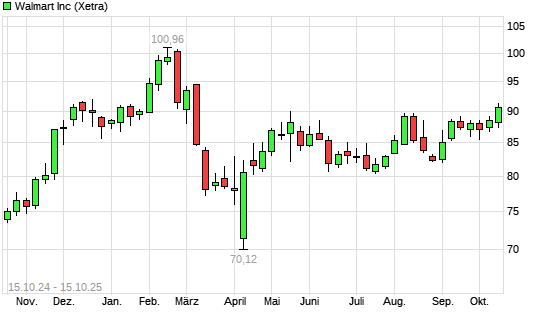

Walmart’s stock has shown resilience in a fluctuating market. After reporting a revenue increase of 8% year-over-year in the second quarter of fiscal 2023, shares climbed by approximately 12% as investors reacted positively to the results. Recent data from markets indicate that Walmart’s stock is trading around $155 per share as of mid-October 2023, backed by strong e-commerce growth and successful seasonal strategies that have attracted increased customer traffic.

The consumer shift towards value-oriented retailers amidst inflation has benefitted Walmart, with the company reporting gains in grocery and online sales. Furthermore, Walmart’s strategic collaborations, particularly in the e-commerce sector, have enabled it to challenge dominant players like Amazon.

Market Factors Influencing Walmart Stock

Several market factors play a role in determining Walmart’s stock movements. Inflationary concerns remain prevalent, pressing consumers towards budget shopping. Additionally, the competitive landscape in retail is evolving, with more emphasis on digital transformation.

Furthermore, recent workforce changes, including wage adjustments and staffing strategies, also impact operational costs, subsequently affecting the stock market performance. Analysts express cautious optimism, suggesting that Walmart’s enhancements in logistics and supply chain management may position it for better cost efficiencies in the long run.

Conclusion and Forecast

In summary, Walmart’s stock remains a barometer for retail health, influenced by broader economic indicators and internal strategies. Analysts suggest a strong outlook for Walmart as it adapts to market changes and continues to leverage its scale and operational efficiencies. Investors are encouraged to monitor the company’s upcoming quarterly earnings reports closely, as they are likely to provide further insights into its financial health and potential for long-term growth.

Walmart’s commitment to innovation, customer satisfaction, and sustainable practices positions it favorably to navigate future challenges in the retail sector, making its stock a significant consideration for those looking to invest in resilient companies.