Introduction

The recent decision by the Bank of Canada (BOC) to cut interest rates has significant implications for the Canadian economy. With inflation concerns and potential recessionary signs, the BOC aims to stimulate growth and encourage consumer spending. Understanding the impact of this rate cut is crucial for businesses, consumers, and investors alike, as it shapes financial landscapes across the nation.

The Rate Cut Details

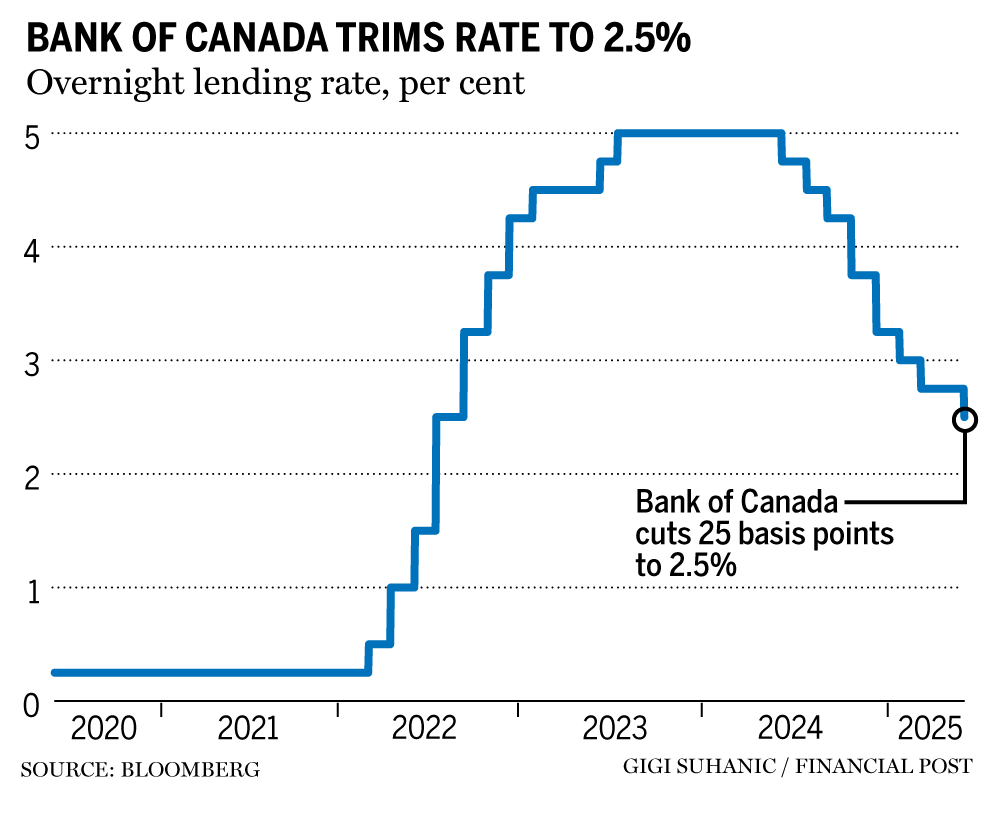

On October 25, 2023, the BOC announced a rate cut of 25 basis points, lowering the benchmark rate from 4.75% to 4.50%. This decision aligns with increasing signs of economic slowdown, as growth forecasts have been revised downwards for the remainder of the year. The BOC’s Governor, Tiff Macklem, emphasized that the rate cut is a strategic move to boost confidence in the economy amid rising global uncertainties and inflationary pressures that remain above the target of 2%.

Potential Economic Effects

The immediate impact of the rate cut is expected to be felt in the borrowing cost. Homeowners with variable-rate mortgages will see lower monthly payments, which should provide some financial relief and potentially increase disposable income. Additionally, businesses are likely to benefit from cheaper loans as they invest in expansion or operational enhancements. This, in turn, could create jobs and promote economic activity, which the BOC hopes will contribute to renewed growth.

However, the long-term effects are yet to be determined. While lower interest rates may lead to increased spending, leading indicators suggest that consumer sentiment remains cautious, particularly due to high living costs and stagnant wage growth. Analysts warn that while the rate cut can boost short-term growth, it might not single-handedly remodel the economic landscape in the face of global uncertainties.

Conclusion

The BOC’s recent rate cut is a significant maneuver aimed at reviving the Canadian economy in a period of challenge. As borrowing costs decrease, the expectation is for an uplift in consumer spending and business investments. However, the balancing act remains complicated due to persisting inflation concerns and consumer sentiment. Monitoring these developments will be crucial for stakeholders across the economy as the BOC navigates the path towards sustainable economic recovery.