Introduction to the Canada Pension Plan (CPP)

The Canada Pension Plan (CPP) is a vital part of Canada’s social security landscape. Established in 1965, the CPP provides financial assistance to Canadians during retirement, as well as disability benefits and survivor benefits for families in the event of a contributor’s death. Understanding the CPP is crucial for Canadians as it plays a significant role in securing financial stability for millions.

How the CPP Works

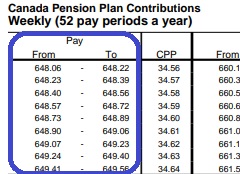

The CPP is funded through mandatory contributions from both employees and employers, where a portion of each person’s paycheck is deducted and added to the CPP fund. As of 2023, the standard contribution rate is set at 5.70% for employees and employers, while self-employed individuals contribute 11.40%. Benefit amounts for retirees are based on how much and how long an individual has contributed to the plan.

Current Events and Changes

Recent developments related to the CPP include proposed increases in benefit amounts. As of 2022, a historic enhancement to the CPP was initiated to gradually increase benefits by 50%, which is set to be fully implemented by 2025. This measure aims to provide greater financial security, particularly for future generations. Additionally, in response to rising living costs, the CPP saw a cost-of-living adjustment of 6.3% in January 2023— the largest increase in decades.

Challenges and Future Outlook

Despite the CPP’s benefits, challenges remain. Analysts have raised concerns regarding the plan’s sustainability, especially in light of Canada’s aging population and the increasing number of beneficiaries. The CPP Investment Board (CPPIB), entrusted with managing the fund’s assets, must navigate global investment landscapes to ensure the long-term viability of the plan.

Conclusion

The Canada Pension Plan represents a critical element of social security for Canadian citizens. As the government continues to revise and enhance the plan, it is important for individuals to stay informed about their contributions and benefits. With ongoing changes in legislation and economy, current and future contributors will need to adapt to ensure their financial fitness in retirement.