Introduction

Figma, a popular web-based interface design tool, has rapidly gained traction among designers and teams worldwide since its inception. Its recent acquisition by Adobe in late 2022 has sparked interest in the company’s market position and potential stock performance, particularly as Adobe prepares for a new phase of integration and innovation. As the tech sector continues to evolve, understanding the standing of Figma stock becomes crucial for investors and participants in the design and software industries.

Recent Developments

In 2023, following its acquisition, Figma has been in the spotlight not only for its innovative design capabilities but also for how it will evolve as part of Adobe’s extensive portfolio. After the acquisition announcement, Figma’s market dynamics changed dramatically, with investors keenly observing how integration with Adobe’s Creative Cloud would influence its growth trajectory.

Since the acquisition, reports indicate that Figma has diversified its features, incorporating artificial intelligence elements aimed at enhancing user experience. As companies remain remote and hybrid, the design tool’s usability has resulted in crucial market share gains, positioning it favorably for increased revenue. This shift in product strategy may enhance Figma’s stock valuation as analysts predict upward trends following the merger’s synergies.

Market Performance and Forecast

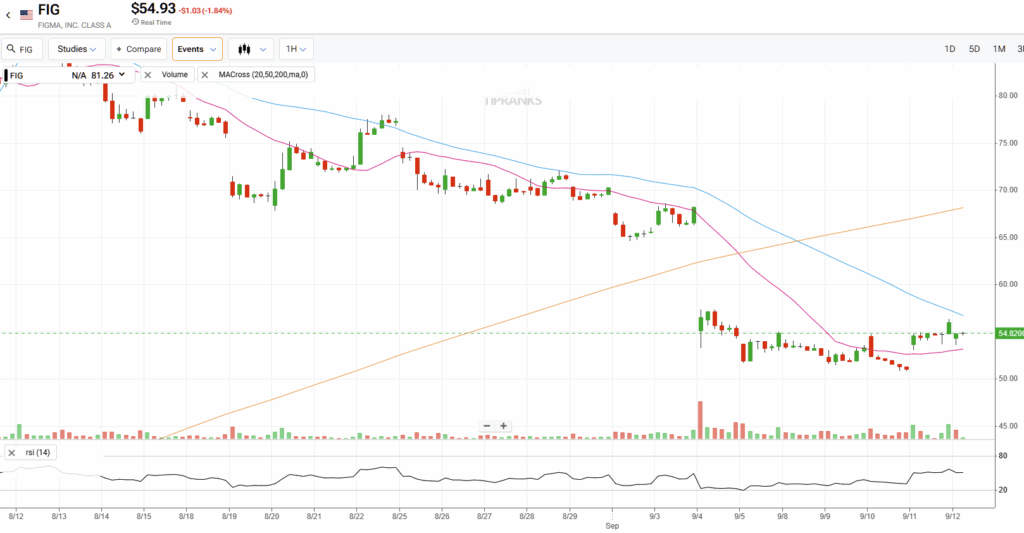

Despite not being an independently traded entity as of now, the implications of Figma’s growth post-acquisition are of great interest to shareholders of Adobe and potential investors. Adobe’s stock performance in 2023 indicates a cautious recovery from market fluctuations, demonstrating the influence of its subsidiary products on overall valuation.

Analysts suggest that as Figma continues to innovate and capture market attention, Adobe’s overall stock performance may benefit significantly. Forecasts for Adobe show a potential uptick in revenue and market confidence associated with the improved functionalities of Figma, especially as companies increasingly look for efficient remote collaboration tools.

Conclusion

The significance of understanding Figma stock, although indirectly tied to Adobe, cannot be underestimated in today’s rapidly changing tech landscape. With AI integration and the ongoing evolution of design needs across industries, Figma is expected to remain a crucial player. Investors should monitor Adobe’s stock performance as a reflection of Figma’s impact and growth in the design tool market. Moving forward, its success could redefine the competitive dynamics of graphic design software, bringing new opportunities for both Adobe and Figma users alike.