Introduction

As the technology and defense sectors continue to grapple with rapid advancements and fluctuating market conditions, Kraken Robotics (TSX: PNG) remains a focal point for investors. The company, based in St. John’s, Newfoundland and Labrador, specializes in underwater robotics and related technologies. Given the rising interest in autonomous systems and military applications, understanding its stock performance is crucial for investors and market watchers alike.

Recent Financial Performance

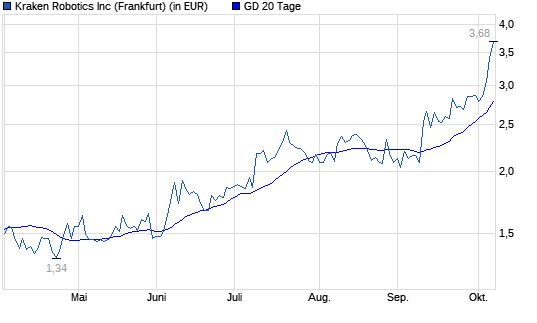

In the past year, Kraken Robotics has experienced a notable journey on the stock market. Since the beginning of 2023, shares have exhibited volatility, reflecting broader trends in the tech industry and the increasing demand for maritime autonomous technologies. As of early October 2023, the stock price is hovering around CAD 2.85, down from its peak in mid-2022. The company reported a 15% increase in revenue during the last quarter, fueled by government contracts that bolster its underwater imaging and drone technology.

Market Outlook

Analysts are cautiously optimistic about the future of Kraken Robotics. With increased funding from both private and government sectors, market experts project a growth trajectory. The Department of National Defence in Canada has recently shown interest in Kraken’s advanced technologies, which could lead to potential contracts worth millions. This represents a significant opportunity for the company to enhance its revenue stream and solidify its status within the niche market of underwater robotics.

Challenges Ahead

Despite the positive outlook, Kraken Robotics faces several challenges. Competition in the robotics and defense sectors remains intense, with various companies vying for a share of the market. Additionally, global economic factors, including inflation and supply chain issues, could impact the company’s growth. Investors should keep an eye on the upcoming quarterly earnings reports and any new contracts or partnerships, as these will provide further insights into the company’s trajectory.

Conclusion

In summary, Kraken Robotics stock presents a mixed bag of opportunities and challenges. As the demand for autonomous underwater technologies grows, the company stands to benefit significantly from its strategic positioning in the market. However, investors should remain vigilant regarding the volatility that can accompany emerging tech stocks. With future contracts and market developments on the horizon, Kraken Robotics will likely remain a critical focus for investors looking to capitalize on advancements in robotics and defense.