Introduction

RGTI stock, representing the shares of RGT International, has been gaining attention lately among investors, particularly due to the company’s strategic initiatives and market performance. Understanding the dynamics of RGTI is crucial for investors and market watchers, especially in a period where market fluctuations are common. This article delves into the recent trends affecting RGTI stock, its market relevance, and what the future might hold for potential investors.

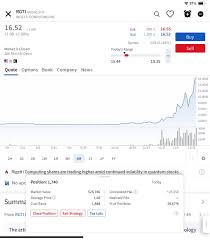

Current Market Performance

As of October 2023, RGTI stock has experienced significant volatility, reflecting the broader trends within the technology sector. The stock price has fluctuated between CAD 15.00 and CAD 20.50 over the past month, driven by investor sentiment and external market forces. Factors such as quarterly earnings reports, news releases regarding product launches, and broader economic indicators have all played a role in these fluctuations.

Recent Developments

Recently, RGT International announced a partnership with a leading tech company, which is expected to enhance its operational capabilities and expand its market presence. This partnership has positively influenced investor perception, contributing to a mild uptick in stock prices following the announcement. Furthermore, the company reported a year-over-year revenue growth of 12% during its last quarterly earnings call, which surpassed analyst expectations and bolstered confidence among investors.

Expert Analysis

Market analysts remain cautiously optimistic about RGTI stock. According to a recent report by Canadian Investment Review, the company’s innovative product line and strategic positioning in the tech market could lead to promising growth. However, experts caution that investors should be prepared for potential challenges, including competition from other tech firms and macroeconomic uncertainties that may impact stock performance.

Conclusion

In summary, RGTI stock presents both opportunities and risks in the current market landscape. Investors are advised to keep an eye on the company’s strategic developments and economic indicators that could influence future performance. With the technology sector continually evolving and RGT International poised to capitalize on new opportunities, staying informed will be key for anyone looking to invest in RGTI stocks. As the year progresses, it will be interesting to observe how RGTI navigates the challenges ahead and leverages its strengths to secure a competitive edge in the market.