Introduction: The Importance of Tracking Enbridge Stock

Enbridge Inc., one of Canada’s largest energy infrastructure companies, plays a crucial role in the country’s energy sector. As a provider of essential energy services, its stock performance is of significant interest to investors and analysts alike. Recent fluctuations in Enbridge’s stock value reflect not only the company’s operational successes and challenges but also broader trends within the energy market. Understanding these trends is essential for both current and potential investors.

Recent Performance and Trends

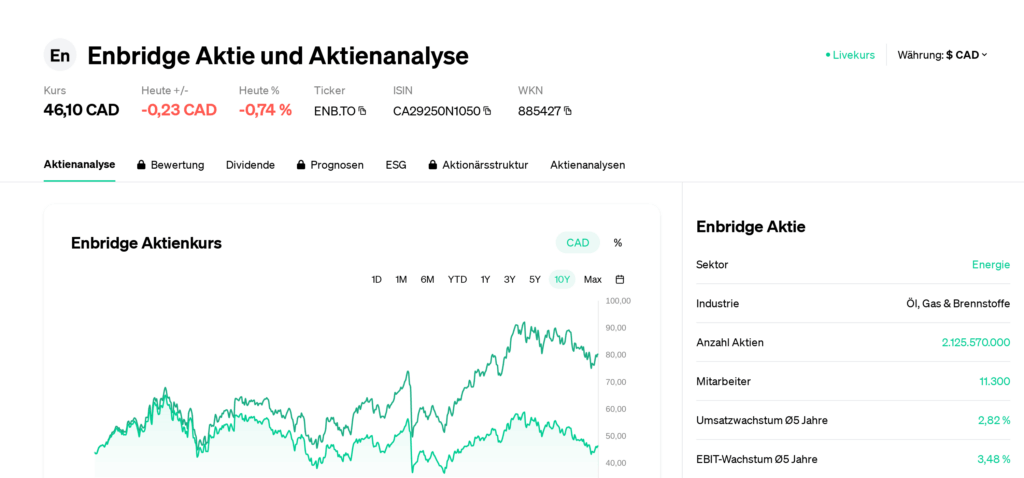

As of late October 2023, Enbridge’s stock has experienced fluctuations, trading around CAD 53 per share. This represents a moderate recovery from earlier drops attributed to global economic pressures and fluctuating energy prices. Analysts indicate that the resilience seen in Enbridge’s stock can be linked to its diversified pipeline assets and the company’s strategic moves towards sustainable energy solutions, including plans to expand renewable energy projects.

In recent earnings reports, Enbridge has showcased a strong financial position, with a reported increase in revenue driven by strong demand for natural gas transportation. Analysts project that this demand will sustain, particularly as global markets adjust to shifting energy needs post-pandemic. The company’s continued focus on safety and regulatory compliance has also enhanced its attractiveness to investors seeking stability in the volatile energy sector.

Market Influences on Enbridge Stock

Several factors impact Enbridge’s stock performance. Firstly, fluctuations in crude oil and natural gas prices play a significant role. As global energy demands evolve, Enbridge’s operations adjust accordingly, influencing investor confidence. Furthermore, the company’s commitment to environmental, social, and governance (ESG) principles aligns well with increasing investor preference for sustainable investments, a fact that has slightly buoyed its stock performance in recent months.

In addition, geopolitical challenges, such as the ongoing conflicts affecting energy supplies globally, add layers of complexity to Enbridge’s market position. Investors are advised to monitor these influences closely, as their potential impacts can cause rapid shifts in stock performance.

Conclusion: What Lies Ahead for Enbridge Stock

Looking forward, analysts suggest that while there may be short-term volatility in Enbridge stock due to external market conditions, its long-term outlook remains positive. With ongoing investments in sustainable energy and a strong operational foundation, Enbridge appears well-positioned to navigate future challenges. For investors, maintaining awareness of market trends and operational developments within Enbridge is crucial for making informed decisions regarding their investments. As the energy landscape continues to evolve, the performance of Enbridge stock will likely be a barometer for broader market conditions in the energy sector.