Introduction: Importance of BMO Stock

Bank of Montreal (BMO) is one of Canada’s major banks with a significant presence in North America and around the globe. BMO stock has gained the attention of investors amid changing economic conditions, interest rates, and earnings reports. Understanding the performance and forecasts related to BMO stock is vital for investors looking to navigate the banking sector in today’s economy.

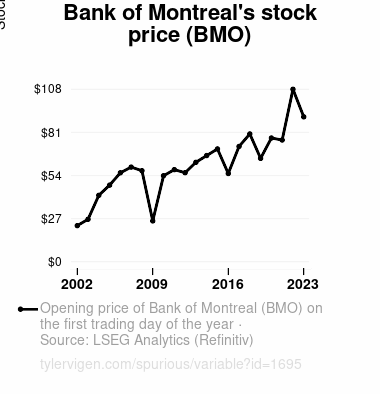

BMO Stock Performance Overview

As of October 2023, BMO stock has shown resilience despite the volatility seen in global markets. Year-to-date, the stock has appreciated by approximately 7%. Factors contributing to this growth include solid quarterly earnings reports and a favorable economic backdrop in Canada, with rising interest rates benefiting banks that earn from net interest income. BMO reported a Q3 2023 net income of $1.52 billion, resulting in a year-over-year increase of 11%.

Key Events Impacting BMO Stock

Recent geopolitical and economic events have also influenced BMO stock’s trajectory. The ongoing recovery from the pandemic, shifting monetary policies from the Bank of Canada, and fluctuating inflation rates have significantly impacted market sentiment. Notably, BMO’s acquisition of Bank of the West last year has diversified its portfolio and expanded its reach into the United States, a strategic move that analysts believe will bolster its growth in the coming years.

Future Forecasts

Analysts remain cautiously optimistic about BMO stock’s future performance. The consensus forecast suggests that BMO could see continued growth, assuming stable economic conditions. Analysts predict that BMO’s earnings per share will rise by approximately 5% annually over the next few years. Furthermore, with ongoing investments in technology and expansion into new markets, BMO is well positioned to benefit from changes in consumer banking behavior.

Conclusion: Investment Relevance

For investors, BMO stock remains an important consideration in a balanced portfolio, showcasing both stability and growth potential. As the banking sector continues to adapt to a dynamic economic landscape, keeping abreast of developments related to BMO will be crucial. The company’s strategic initiatives, strong performance metrics, and market adaptability suggest that BMO stock could be a solid investment choice for those looking to diversify their holdings in the financial industry.