Introduction

Tax-Free Savings Accounts (TFSAs) are a crucial savings tool for Canadians, allowing them to invest and earn income without tax implications. As we are looking ahead to 2026, understanding the projected contribution limit is essential for effective financial planning. TFSAs have become increasingly popular, with millions of Canadians utilizing them to save for various goals, including retirement, education, and emergency funds.

Current Contribution Limits and Historical Context

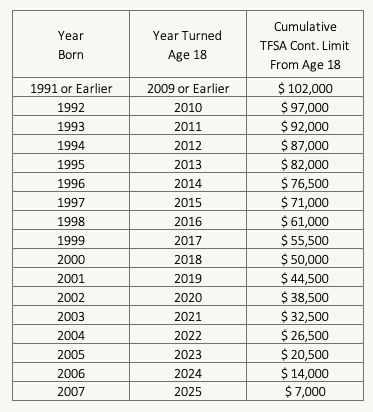

As of 2023, the annual TFSA contribution limit is set at $6,500. The limit has fluctuated since the program’s inception in 2009, with periodic adjustments to account for inflation. The current forecast anticipates that for the year 2026, the contribution limit will rise to $7,100. This increase reflects the Ontario Consumer Price Index and aims to maintain the purchasing power of the contribution room.

Breaking Down the Changes

The increase in the TFSA contribution limit can have significant implications for individual financial strategies. Assuming a gradual increase, this rise in 2026 is expected to benefit both new and existing account holders, allowing them to save more effectively for their financial goals. The cumulative contribution room enables Canadians to accumulate funds efficiently, maximizing their tax-free investment growth over the years.

Why It Matters

For Canadians, a higher TFSA limit means enhanced opportunities for investment and savings. With the projected increase, individuals can plan more strategically. Moreover, those who have previously maximized their contributions could further their investment strategies, allowing for diverse portfolios. Increased limits also support those facing inflationary pressures, granting them more leeway as they navigate economic challenges.

Conclusion

As we gear up for 2026, the anticipated contribution limit of $7,100 for TFSAs will play a pivotal role in shaping Canadians’ financial futures. By understanding these changes, Canadians can better prepare for maximizing their savings. Whether for retirement or other long-term financial goals, the TFSA continues to be a vital component of personalized financial planning. Keeping informed about such updates ensures Canadians not only comply with regulations but also optimize their financial opportunities.