Introduction: The Importance of Tracking ASTS Stock

As the financial markets continue to evolve, tracking the performance of specific stocks like ASTS (American Securities Trust and Services) has become increasingly important for investors. Understanding stock performance, market trends, and investment opportunities can lead to informed decisions. ASTS, which is known for its innovations in the technology and finance sectors, has recently garnered attention amidst significant market shifts. In this article, we will delve into the latest trends related to ASTS stock and analyze what they mean for investors.

Recent Performance and Market Trends

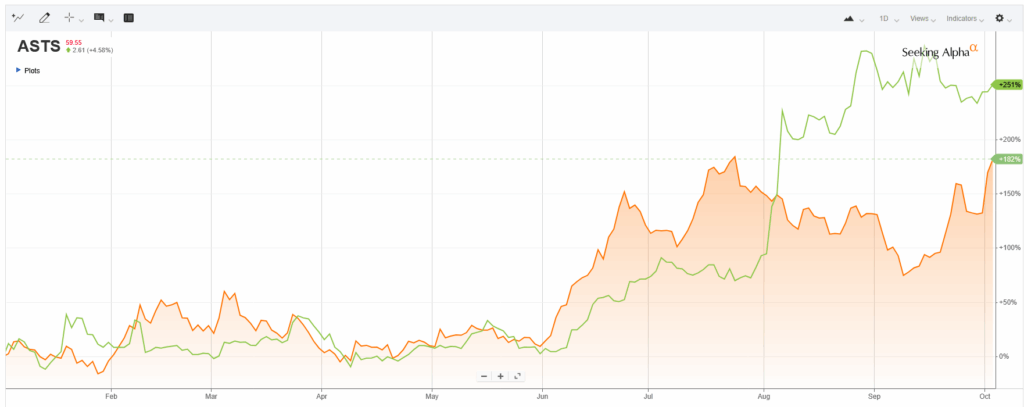

In recent months, ASTS stock has experienced a mix of volatility and opportunity. According to data from Yahoo Finance and Bloomberg, ASTS shares have fluctuated between USD 5.50 and USD 8.00 over the past few months, reaching a peak due to favorable quarterly earnings reports and strategic partnerships. Analysts have reported a rise in volume, indicating heightened investor interest and activity surrounding the stock.

One of the driving factors behind this stock’s performance has been the company’s strategic focus on innovative technologies within the financial sector. With the increasing demand for digital finance solutions, ASTS is positioning itself as a key player. Additionally, the financial markets have shown an overall bullish sentiment, favoring technology stocks, which reflects positively on ASTS’s performance.

Key Events Influencing ASTS Stock

Several key events have influenced the recent movements in ASTS stock. The announcement of new product launches aimed at enhancing customer experience has been well received by the market. Furthermore, the company has secured a major partnership with a leading financial institution, which is expected to broaden its reach and services. These developments have led to increased investor confidence, evidenced by the recent price uptick.

Moreover, ASTS’s commitments to sustainable business practices and corporate social responsibility are factors that resonate with today’s investors looking for socially responsible investments. This aspect has also contributed to an enhanced public perception of the company.

Conclusion: What Lies Ahead for ASTS Stock

Looking ahead, investors in ASTS stock should remain cautiously optimistic but vigilant. As the company navigates through a competitive landscape while implementing its growth strategies, market performance may remain volatile. Analysts recommend keeping an eye on global economic indicators and technology sector trends that could impact ASTS’s stock price.

In conclusion, the ASTS stock is currently an intriguing option for investors who are willing to delve into a detailed analysis of underlying market conditions and the particular strengths of the company. Staying informed and open to market changes will be crucial for any investment decisions moving forward.