Introduction

The recent increase in terminations of banking relationships has caught the attention of many customers and financial experts alike. Specifically, the Royal Bank of Canada (RBC) has seen a noticeable rise in cases where individuals and businesses have faced abrupt banking relationship terminations. Understanding the reasons behind such terminations, the processes involved, and what customers can do in response is increasingly relevant in today’s economic landscape.

Reasons for Banking Relationship Termination

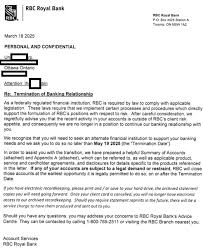

RBC, like other financial institutions, has the right to terminate banking relationships for several reasons. According to their publicly available guidelines, such terminations can occur due to factors like breach of contract, suspicious activities that could indicate fraud or money laundering, and compliance issues related to anti-money laundering (AML) regulations. In a recent announcement, RBC emphasized their commitment to adhering strictly to these regulations, which may lead to difficult decisions regarding customer accounts.

Recent Developments

In light of the evolving financial landscape and increased regulatory scrutiny, RBC has streamlined its process for assessing customer relationships. In 2023, several reports emerged from clients expressing surprise at the sudden termination of their accounts without clear communication or explanation from the bank. Financial observers have noted that these decisions often stem from internal risk assessments that prioritize the institution’s reputation and compliance with governmental regulations.

Furthermore, RBC has been expanding its digital banking services, which could complicate traditional banking relations. As the bank moves towards enhanced digital frameworks, discrepancies in account management and customer monitoring may contribute to relationship terminations when clients are unable to meet new compliance standards.

What Customers Should Know

For customers facing the risk of termination, understanding their rights is crucial. RBC clients are encouraged to read through their account agreements carefully, noting any clauses related to termination. If an account is terminated, customers have the right to request an explanation, and if dissatisfied with the response, may seek further assistance through regulatory bodies such as the Financial Consumer Agency of Canada.

Conclusion

In summary, while RBC’s banking relationship terminations can be unsettling, they also serve as a reminder of the complexities and responsibilities tied to financial services in Canada. As the banking sector continues to evolve, both clients and institutions must remain vigilant in understanding their rights and obligations. Looking forward, it’s anticipated that banks, including RBC, will refine their communication processes and relationship management strategies to mitigate potential disruptions and uphold trust with their customers.