Introduction

SMCI stock, representing Super Micro Computer, Inc., has been making headlines in the technology sector, especially with the increasing demand for high-performance computing solutions. The relevance of SMCI stock extends beyond just financial performance; it embodies the shift towards advanced computing infrastructures that are crucial in various industries including data centers, cloud service providers, and edge computing technologies. As we navigate through 2023, investors and industry analysts are keenly watching this stock to gauge future market trajectories.

Recent Market Performance

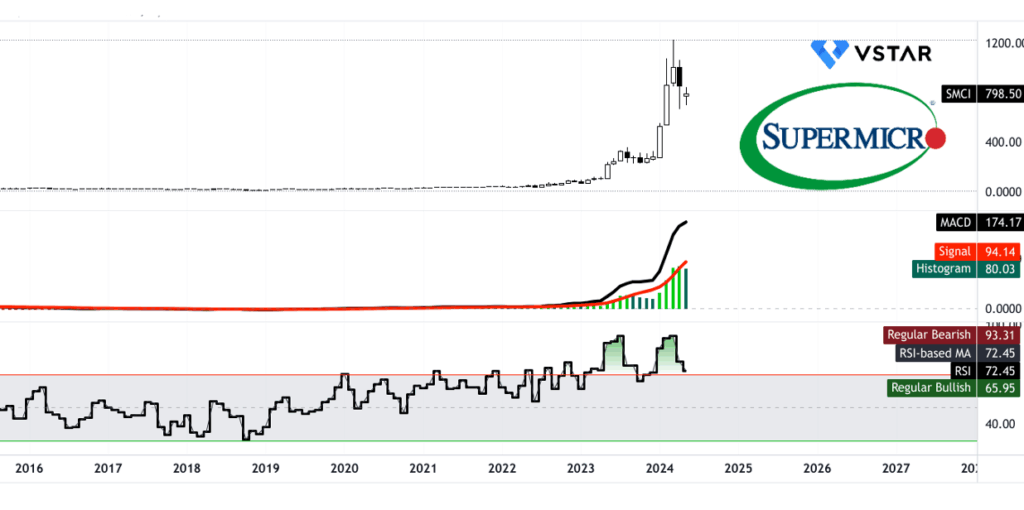

As of October 2023, SMCI stock has shown a remarkable resilience and upward trend, with its value rising approximately 65% year-to-date. Recently, the stock touched an all-time high of $275 per share, reflecting robust quarterly earnings that significantly surpassed analysts’ expectations. In its latest earnings report, Super Micro announced revenues of $1.1 billion, up 50% year over year. The company attributed this growth to the surging demand for their products, which are widely used in data centers and cloud solutions.

Factors Influencing SMCI Stock

Several key factors contribute to the growing interest in SMCI stock:

- Innovation in Technology: Super Micro continues to invest heavily in research and development, introducing cutting-edge solutions such as AI-optimized server systems and energy-efficient products.

- Market Demand: The accelerating trend toward digital transformation in various sectors has led to increased demand for high-performance servers.

- Strategic Partnerships: Recent partnerships with major tech players for developing advanced data center solutions have further bolstered investor confidence.

Investor Considerations

While SMCI stock has presented promising growth, potential investors must consider market volatility and economic conditions that could impact technology stocks broadly. Analysts recommend keeping an eye on interest rate trends and global supply chain issues, which remain integral to the tech industry. Furthermore, as competition in the server market intensifies, SMCI must leverage innovation and adaptability to maintain its market position.

Conclusion

In conclusion, SMCI stock stands at a pivotal point in the tech market, drawing considerable attention due to its robust performance and the overall growth of the technology sector. For investors, it presents both opportunities and challenges. As the demand for high-performance computing continues to rise, SMCI’s future seems promising, making it an intriguing option for those looking to diversify their portfolios in the technology realm. Observers will need to stay informed about market conditions and company developments to make well-informed investment decisions.