Introduction to OAS and CPP Retirement Age

The Retirement age for the Old Age Security (OAS) and the Canada Pension Plan (CPP) is a crucial topic for Canadians approaching retirement. Understanding the implications of these retirement benefits is essential for effective financial planning. With recent discussions surrounding potential increases in retirement age, many Canadians are eager to learn how these changes could affect their future financial security.

Current OAS and CPP Retirement Age Regulations

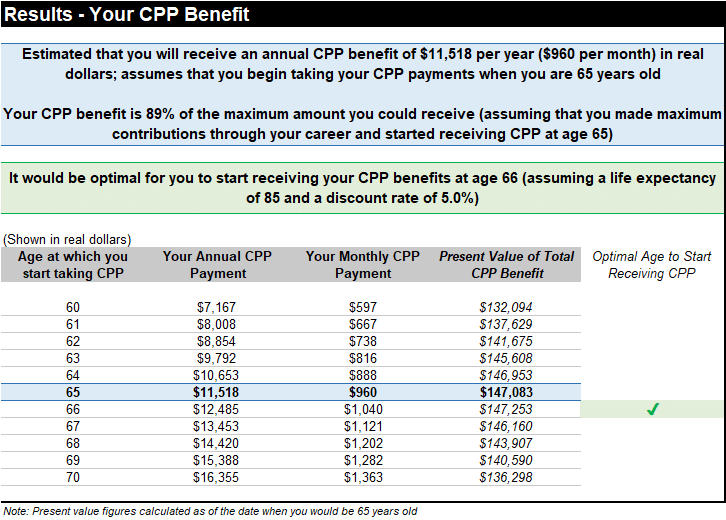

Currently, the standard retirement age for OAS benefits is set at 65 years, while individuals can start receiving CPP benefits as early as 60 years, with a subsequent reduction in monthly payments. Alternatively, Canadians can choose to delay CPP benefits until age 70 to potentially receive higher monthly payouts. Recent Statistics Canada reports indicate that the average life expectancy in Canada has increased, leading to concerns about the sustainability of these programs amidst an ageing population.

Government Consultations and Proposed Changes

The Canadian government has initiated consultations regarding OAS and CPP benefits, primarily focusing on sustainability and financial viability for future generations. Analysts suggest that one of the proposed options is to gradually increase the retirement age, similar to measures taken in other countries. For instance, nations like Germany and the United States have implemented a phased approach to increase retirement ages, which has sparked discussions within Canada on potential reforms.

Implications for Future Retirees

Any changes to the OAS or CPP retirement age could have significant implications for millions of Canadians. Individuals nearing retirement may have to adjust their financial plans based on revised timelines for receiving benefits. Furthermore, younger Canadians could face a different landscape where planning for retirement includes potential delays in accessing these crucial supports. Financial advisors are urging individuals to consider these factors and to review their retirement strategies periodically to accommodate any changes that may arise.

Conclusion: The Future of Canada’s Retirement System

As Canada grapples with an ageing demographic and evolving economic conditions, the discussions surrounding the retirement age for OAS and CPP remain relevant and critical. The potential shifts in policy could reshape how Canadians plan for retirement over the coming decades. Maintaining awareness of these changes is essential for individuals to secure their financial futures. Canadians of all ages should stay informed on developments in retirement policy to adequately prepare and adapt for their retirement years.