Introduction

MU stock, which represents Micron Technology, Inc., plays a significant role in the technology sector as a major provider of memory and storage solutions. With the increasing dependence on data and cloud technologies, understanding the movement of MU stock is crucial for investors and tech enthusiasts alike. As of late October 2023, there have been noteworthy developments regarding the stock that merit attention.

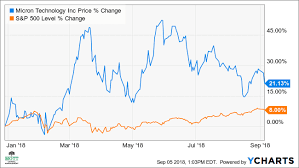

Recent Performance of MU Stock

As reported in the latest financial news, MU stock has experienced fluctuations amid broader market trends and sector-specific challenges. Since the beginning of October 2023, the stock has seen a rise of approximately 15%, rebounding from its previous lows. Analysts attribute this uptick to better-than-expected earnings reported for the last quarter, which surpassed Wall Street’s estimates. Micron reported a revenue of $6.5 billion, reflecting a 20% increase year-over-year, with strong demand for their DRAM products, particularly from data centers.

Factors Influencing MU Stock

A major contributor to the stock’s performance is the ongoing global chip shortage, which has pressed manufacturers and tech companies to secure reliable partnerships with suppliers such as Micron. Additionally, the expanding artificial intelligence (AI) ecosystem drives enhanced demand for sophisticated memory solutions, positively impacting Micron’s market position. Furthermore, analysts have pointed out that upcoming product launches, including new generations of memory chips tailored for AI processing, could bolster revenue streams and investor confidence.

Market Outlook

Looking ahead, market analysts suggest a cautiously optimistic outlook for MU stock. According to projections from reputable financial institutions, MU stock price targets could reach between $80 and $100 in the coming months, assuming that demand remains robust and supply chain issues are managed effectively. However, potential risks include inflationary pressures and geopolitical developments that may impact semiconductor exports, primarily to key markets such as China.

Conclusion

In summary, MU stock is currently positioned as a strong player in the semiconductor industry, guided by favorable demand trends and solid financial performance. The expectation of continued growth in cloud technology and artificial intelligence applications points to a promising future for Micron Technology. Investors are advised to stay informed on market trends, earnings reports, and geopolitical developments to make well-grounded investment decisions. As more data emerges, MU stock will continue to be a focal point for tech investors looking to capitalize on the evolving landscape of technology.