Introduction to LAC Stock

Investing in the stock market has always drawn both seasoned and novice investors, and one of the stocks that have captured attention recently is LAC stock, representing Lithium Americas Corp. As the demand for lithium surges due to the electric vehicle (EV) boom and wider adoption of renewable energy storage solutions, LAC stock has become synonymous with the growing green economy. Understanding the current events surrounding LAC stock is vital for investors looking to capitalize on market trends or mitigate potential losses.

Current Market Performance and Recent Developments

As of October 2023, LAC stock has seen a significant increase in its value, reflective of rising lithium prices driven by global electrification initiatives. Just last month, Lithium Americas announced the start of construction on its Thacker Pass lithium project in Nevada, which is poised to become one of the largest lithium mines in North America once operational. This development is crucial as it marks a significant step toward bridging the supply-demand gap in the lithium market.

Furthermore, LAC’s collaboration with General Motors to secure lithium supply for EV batteries has garnered attention, reaffirming the growing strategic significance of lithium supply chains. The partnership is expected to fortify the North American lithium sector and mitigate reliance on foreign sources, which has been a key issue highlighted in recent legislative discussions.

Financial Projections and Analyst Commentary

Analysts are maintaining an optimistic outlook on LAC stock, with several investment firms expressing bullish sentiments based on strong projected earnings and market share growth. According to a report from Market Research Future, the lithium industry is expected to grow at a CAGR of over 20% in the coming years, suggesting that companies like Lithium Americas are well-positioned to leverage their assets.

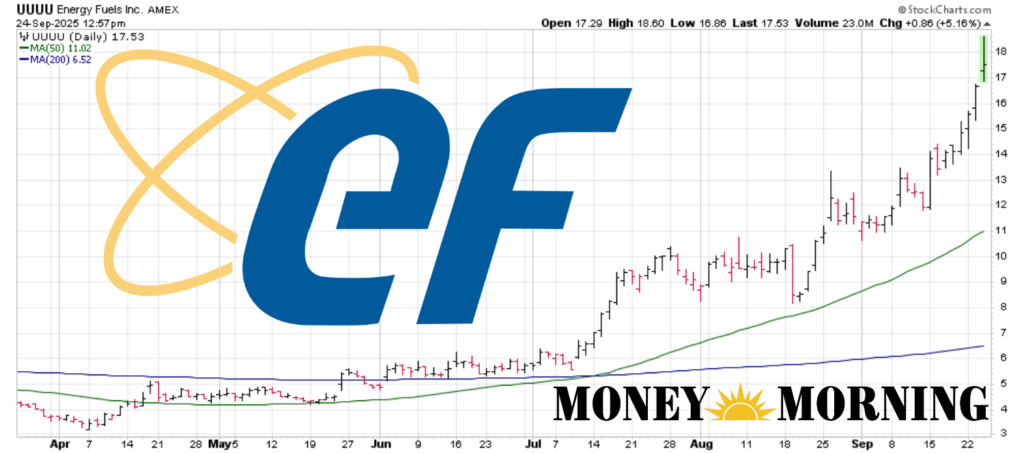

Investor interest is reflected in the increased trading volume of LAC stock. As more investors recognize the potential of lithium investments in relation to global sustainability goals, the stock is likely to see continued volatility as it factors in not just current market conditions but also future geopolitical and economic influences.

Conclusion: What Lies Ahead for LAC Stock?

In summary, LAC stock presents a compelling opportunity for investors keen on riding the wave of the green revolution and electric mobility initiatives. With significant developments on the operational front and a favorable market outlook, Lithium Americas Corp is poised to make a marked impact in the lithium sector. However, potential investors should remain cautious of market volatility and the importance of due diligence in evaluating their investment choices. As demand for lithium is projected to rise sharply over the next decade, LAC stock may prove to be a valuable addition to an investment portfolio focused on innovation and sustainability.