Introduction

Uber Technologies Inc. has become a household name, reshaping the transportation industry with its ride-hailing service. However, the company’s performance in the stock market is closely watched by investors and analysts alike. Understanding Uber stock is essential, particularly as it may reflect broader market trends and the company’s operational efficacy during a time of economic uncertainty.

Current Performance of Uber Stock

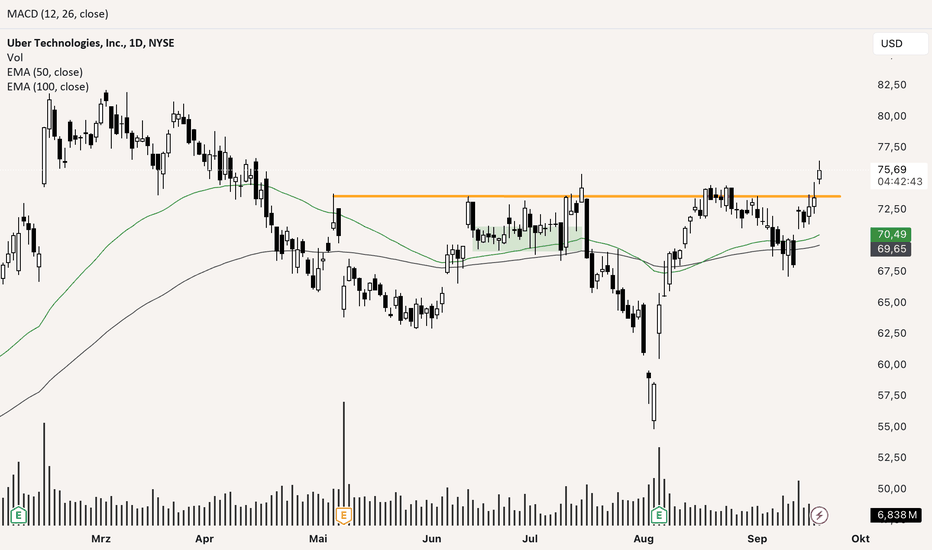

As of late October 2023, Uber’s stock is showing signs of resilience amidst fluctuating market conditions. Following a turbulent couple of years impacted by the pandemic and evolving consumer behaviors, Uber shares have rebounded, trading approximately 15% higher than earlier this year. Analysts attribute this growth to a surge in post-pandemic ridership, solid earnings reports, and effective cost-cutting measures implemented by the company.

Recent Developments

Several key events have influenced Uber’s stock price in recent months. In its most recent quarterly earnings report, Uber reported a revenue increase of 40% year-over-year, driven primarily by its delivery service, Uber Eats, which continues to see heightened demand in urban areas. Additionally, the company announced plans to expand its logistics and freight services, which are expected to contribute to further revenue growth. These initiatives have led investors to exhibit a more bullish sentiment toward Uber stock.

However, amidst the positive developments, Uber faces challenges, including increased competition from other ride-hailing services and regulatory pressures in global markets. Government regulations could potentially affect profitability if stricter laws around gig economy workers are implemented, particularly in key markets such as California and the European Union.

Future Outlook

Looking ahead, analysts remain cautiously optimistic about Uber stock. Investment firms have set diverse price targets, reflecting varying opinions about the company’s short and long-term potential. Some analysts believe that Uber could reach an all-time high within the next year if it successfully navigates regulatory hurdles and capitalizes on its expanding service divisions.

Conclusion

In conclusion, Uber stock presents an intriguing opportunity for potential investors. While the company’s recovery post-pandemic has shown promising results, various market and regulatory factors could influence its future trajectory. Investors should keep a close eye on Uber’s quarterly earnings, industry trends, and market conditions to make informed decisions. With both opportunities and risks lying ahead, Uber continues to evolve as a major player in the mobility and delivery sectors, and its stock performance will undoubtedly be a topic of interest in the financial community.