Introduction to the Canada Pension Plan

The Canada Pension Plan (CPP) is a vital part of Canada’s social safety net, providing financial security to retirees, disabled individuals, and survivors of deceased contributors. As Canada grapples with an aging population and shifting economic landscapes, understanding the current status and future developments of the CPP becomes increasingly important for all Canadians.

Current Developments in the Canada Pension Plan

As of 2023, Canada is witnessing significant changes to the CPP. In 2016, the federal government enacted a major expansion of the plan, aimed at increasing benefits for future retirees. This expansion is being phased in gradually, with the first increases for new contributors anticipated to begin in 2024. According to the latest data from Employment and Social Development Canada, the maximum monthly amount that new recipients could receive is projected to rise significantly, reflecting the need for greater retirement security in light of rising living costs.

Financial Sustainability and Contributions

The CPP is funded through mandatory contributions from both employees and employers, calculated as a percentage of earnings. As of 2023, the contribution rate is set at 5.70%, with plans to increase this rate slightly over the coming years to support the forthcoming benefits expansion. Experts predict that, barring major economic disruptions, the CPP will remain financially sustainable well into the coming decades. The Canada Pension Plan Investment Board (CPPIB), which manages the funds, continues to seek prudent investment strategies to ensure stability and growth.

Public Perception and Education

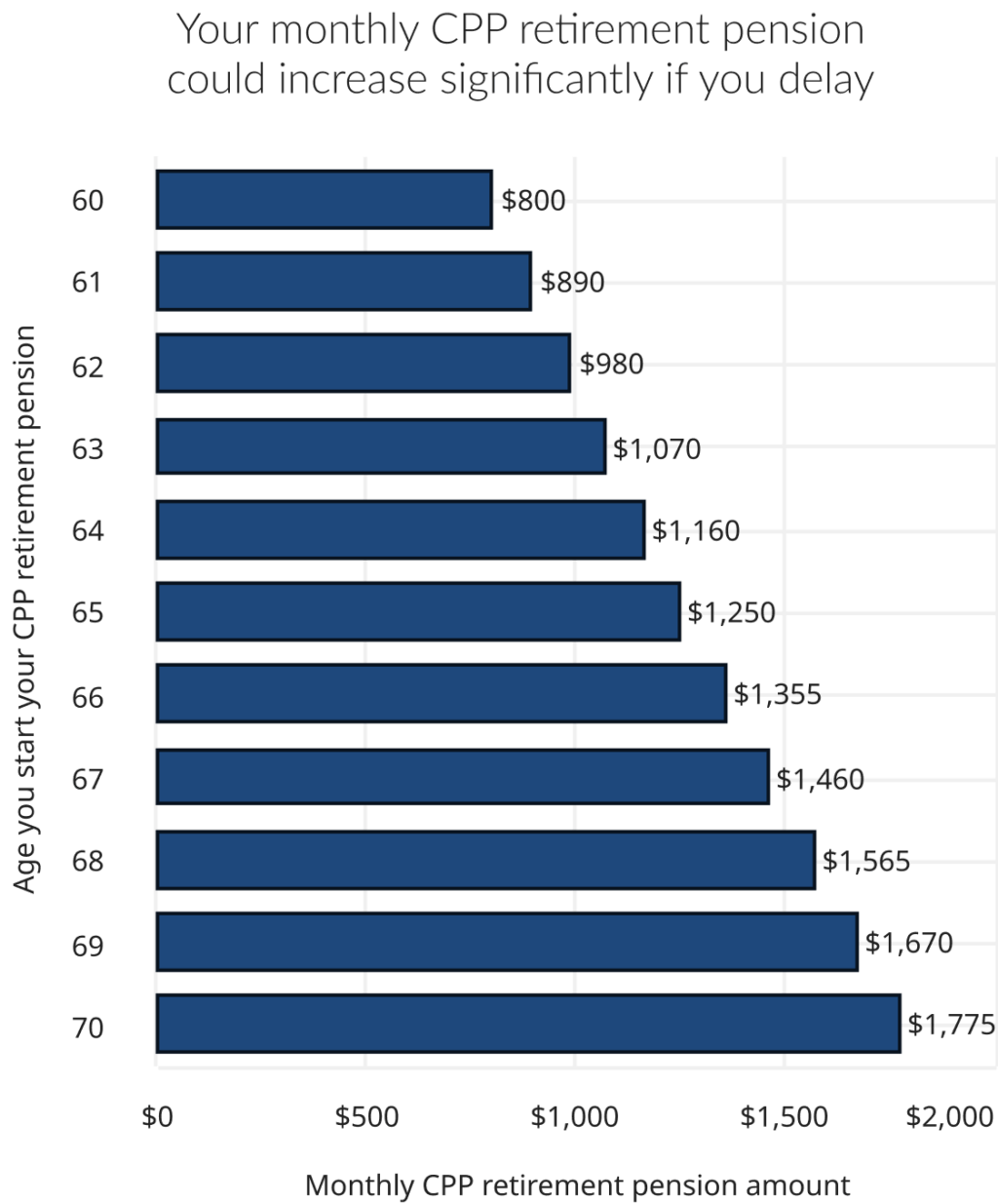

Despite its importance, many Canadians are not fully aware of how the CPP works or the benefits it provides. Recent surveys show a need for increased public education on the CPP’s mechanics and how individuals can maximize their benefits. Financial literacy initiatives and resources are being implemented to help Canadians make informed decisions about their retirement planning.

Conclusion: The Future of the Canada Pension Plan

As Canada moves forward, the Canada Pension Plan will play a pivotal role in ensuring that its citizens can retire with dignity. The implemenation of new benefits amidst an evolving economic landscape is promising, but underscores the continued need for awareness and understanding among Canadians. As governments adapt policies related to the pension plan, it will be crucial for individuals to stay informed and engaged. The future of the CPP, while bright, depends on collective vigilance and proactive financial planning by current and future generations.