Introduction

The Royal Bank of Canada (RBC) is one of the largest financial institutions in the country, with a significant presence in both domestic and international markets. As a key player in the banking sector, RBC’s stock performance is crucial for investors and analysts alike, making it a topic of great importance. In recent months, RBC stock has navigated various economic challenges, including interest rate fluctuations and changes in consumer behavior, which have made it a focal point in financial news. This article takes a closer look at RBC stock’s recent performance, market factors influencing it, and future forecasts.

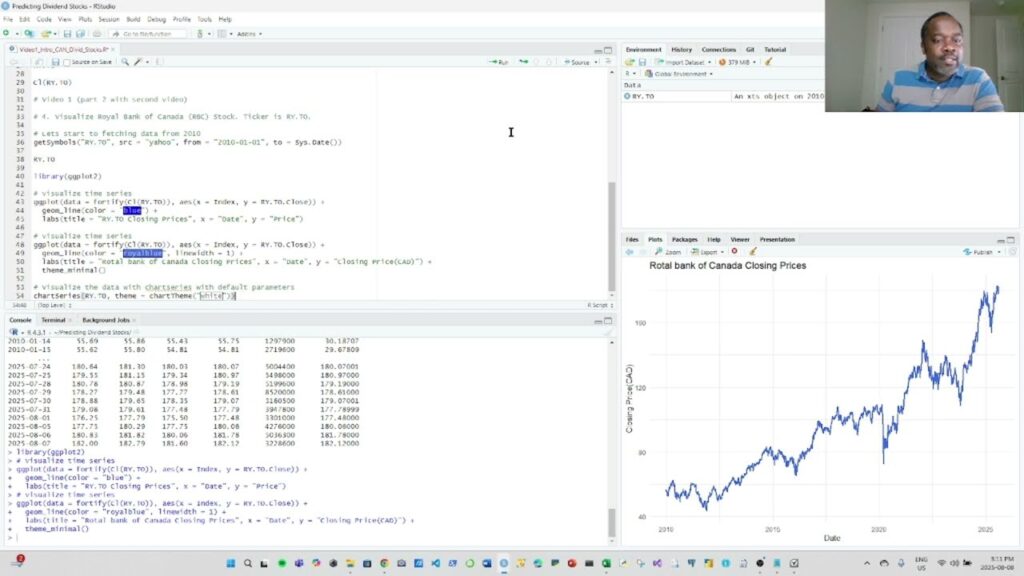

Recent Performance

As of late September 2023, RBC stock has shown resilience amid volatility in the financial markets. Trading around CAD 135 per share, it marked a modest increase compared to previous months, fueled by a strong earnings report earlier this quarter. RBC reported a net income of CAD 3.5 billion for the third quarter of 2023, representing a year-over-year increase of 7%. This performance reflects robust growth in its personal and commercial banking segments, which are the backbone of its business model.

Market Influences

Several factors have influenced RBC stock’s movement recently. The ongoing economic landscape, marked by high inflation and fluctuating interest rates, has created a challenging environment for banks. The Bank of Canada’s decision to hold interest rates steady has provided some stability but poses questions about future borrowing costs. Analysts believe that should the economy show signs of slowing growth, lowering interest rates could become a tool for stimulation, benefitting institutions like RBC.

Moreover, RBC’s strategic investments in technology and digital banking are seen as key drivers for future growth. The bank has been shifting towards enhancing customer experiences through digital solutions, which may contribute positively to its earnings in the coming quarters. This pivot to technology is especially crucial as consumer preferences continue to evolve rapidly.

Future Outlook

Looking forward, analysts maintain a cautiously optimistic perspective on RBC stock. The bank’s strong fundamentals, coupled with its proactive strategies towards digital transformation, position it well for future challenges. Market forecasts suggest that RBC stock could continue to perform robustly, provided that economic conditions stabilize. Many financial experts recommend RBC as a hold for long-term investors, emphasizing its strong dividend yield and growth potential.

Conclusion

In conclusion, RBC stock remains a critical subject for both investors and market watchers. As it navigates through economic uncertainties and aligns its strategies towards modern banking technologies, its performance warrants close attention. Investors should keep an eye on economic indicators and RBC’s quarterly results, which will provide insight into its path forward in a rapidly changing financial landscape.