Introduction

The CIBC Prime Rate is a critical financial indicator that affects loans, mortgages, and everyday banking products in Canada. As the economy continues to experience fluctuations, understanding changes to the prime rate is essential for consumers and businesses alike. Recent adjustments have prompted discussions about borrowing costs and savings, underscoring the relevance of keeping informed about these financial trends.

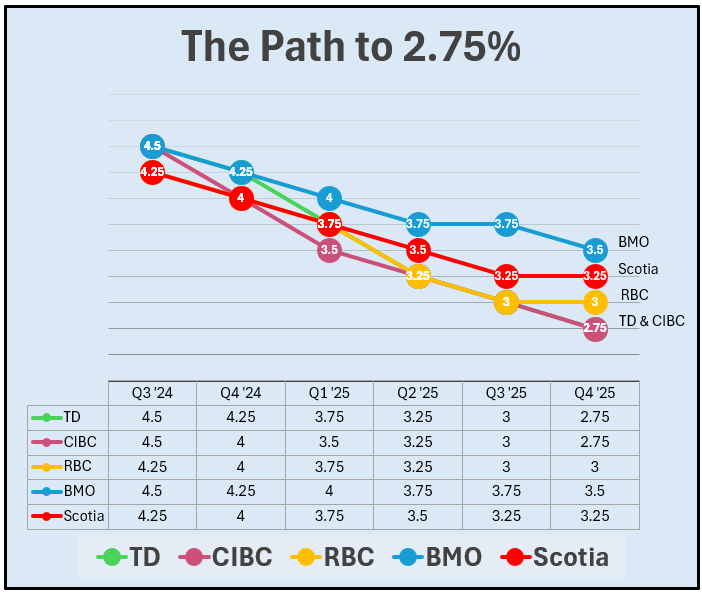

Recent Changes to CIBC Prime Rate

As of October 2023, CIBC (Canadian Imperial Bank of Commerce) has adjusted its prime rate to 6.95%. This change reflects the central bank’s ongoing efforts to manage inflation, which reached a peak of 8.1% in June 2022 and has gradually declined since. Following the Bank of Canada’s decision in early October to maintain its overnight rate at 5.0%, some analysts anticipated that financial institutions, including CIBC, would respond by recalibrating their prime rates accordingly.

The Economic Context

The increase in CIBC’s prime rate is part of a broader trend as Canadian banks continue to respond to the Bank of Canada’s monetary policy actions. The prime rate serves as the baseline for variable-rate loans, including home equity lines of credit (HELOCs) and personal loans, meaning that changes in the prime rate directly affect borrowers’ repayments. For homeowners, the implications can be significant, particularly for those with variable-rate mortgages. Higher prime rates typically lead to increased monthly mortgage payments, thus affecting household budgets and overall consumer spending.

Impact on Consumers and Businesses

With the current prime rate standing at 6.95%, individuals with loans tied to the prime rate may now see their interest payments climb. This rate hike may deter new borrowing, influencing both consumer and business decisions. Businesses reliant on loans for capital investments may also feel the pinch, as continuing to borrow in a higher interest environment necessitates careful financial planning. Meanwhile, savers may find that higher rates lead to increases in interest earned on savings accounts, providing a slight silver lining.

Conclusion

The recent announcement regarding the CIBC prime rate is a pivotal moment for the Canadian economy and its financial landscape. As borrowing costs rise, both consumers and businesses will need to navigate these changes with strategic financial planning. Monitoring how the prime rate fluctuates in response to economic indicators will remain essential for Canadians looking to optimize their financial decisions. Experts suggest that the Bank of Canada will continue to assess economic conditions closely, which may influence future adjustments to the prime rate. Overall, staying informed about these developments can empower Canadians to make sound financial choices moving forward.