Introduction

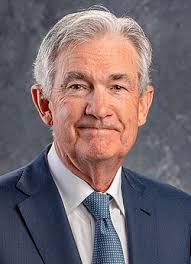

Jerome Powell, the 16th Chair of the Federal Reserve, plays a pivotal role in shaping the landscape of U.S. monetary policy. His decisions significantly influence interest rates, inflation, and overall economic stability. Amidst ongoing economic challenges, including rising inflation and potential recession, Powell’s actions have garnered widespread attention and discussion.

Recent Developments

In recent months, Powell has faced a complex environment characterized by high inflation rates not seen in decades. As of September 2023, inflation remains above the Federal Reserve’s target of 2%, prompting Powell to adjust monetary policy to combat these economic challenges. In September, the Fed decided to hold interest rates steady at 5.25%-5.50%, but Powell indicated that further rate hikes could be necessary depending on economic performance and inflation trends.

Powell’s Policies and Reactions

Powell’s approach has included a series of interest rate hikes over the past year, aimed at cooling down the economy. These measures are intended to decrease consumer spending and borrowing, which in turn should ease inflation. However, the trade-off has raised concerns among economists regarding the potential for a recession. A recent survey from the National Association for Business Economics suggests that many economists believe a recession is likely within the next year, attributing it to the Fed’s aggressive rate policies under Powell’s leadership.

The Future of Monetary Policy

Looking ahead, Powell’s predictions and decisions will continue to be crucial. The Federal Reserve’s next steps involve a delicate balancing act—nurturing economic growth while controlling inflation. Powell’s commitment to transparency has helped maintain market confidence, yet the pressure remains high due to geopolitical tensions, supply chain disruptions, and persistent inflationary pressures.

Conclusion

Jerome Powell’s stewardship of the Federal Reserve is a critical factor in navigating current economic uncertainties. As inflation persists and concerns regarding a recession grow, his policies will be closely scrutinized by economists, businesses, and the public alike. Understanding Powell’s decisions will be essential for predicting how the economy may evolve in the coming months and years, highlighting the integral role of sound monetary policy in fostering economic stability.