Introduction

Investing in stocks requires careful consideration of market trends, company performance, and broader economic factors. Uber Technologies, Inc. (NYSE: UBER) has become a focal point for investors, especially in the ride-hailing and delivery service sectors. With the ongoing recovery of the global economy post-pandemic, understanding Uber stock’s trajectory is crucial for current and prospective investors.

Recent Performance of Uber Stock

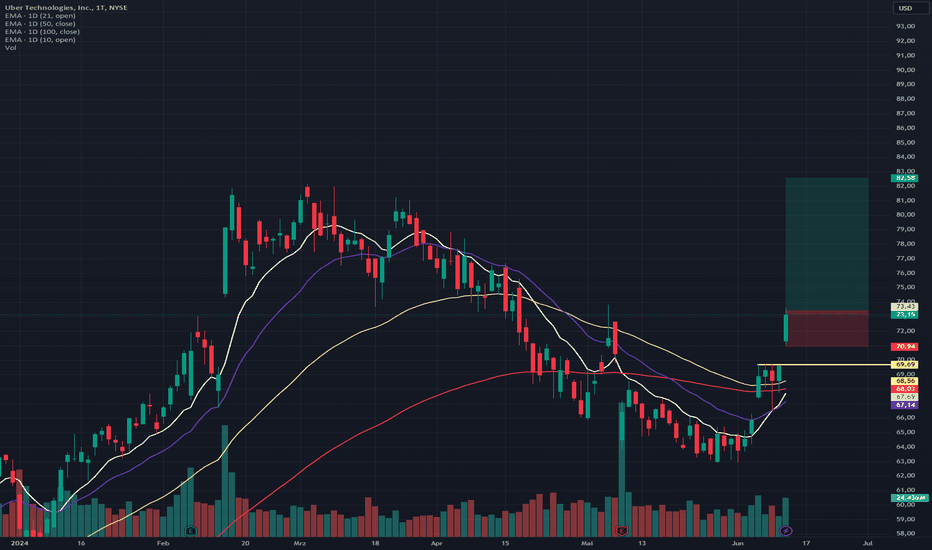

As of October 2023, Uber’s stock has seen significant fluctuations, reflecting both investor sentiment and external economic conditions. After a notable revival in the first half of the year, the stock price recently hovered around $30 per share, a recover from its pandemic lows. Analysts attribute this rebound to the company’s strong performance in its delivery segment, particularly Uber Eats, as consumer behavior shifts towards online ordering.

According to a recent earnings report, Uber reported a net revenue increase of approximately 30% from the same quarter last year. Factors contributing to this growth include strategic partnerships, expanded service offerings in new markets, and increased market penetration in existing sectors. Furthermore, operational efficiencies and cost-cutting measures have improved profit margins, which has been well-received by investors.

Market Reactions and Future Outlook

The broader market reactions to Uber’s performance have been mixed. While some investors remain bullish on the stock’s potential for growth, others are cautious due to regulatory challenges and competition from rivals like Lyft and DoorDash. The concern hinges on potential government regulations that could impact the gig economy model, which underpins Uber’s business practices.

Industry experts predict that while challenges remain, Uber’s ongoing diversification into logistics and freight services could provide new revenue streams and mitigate risks associated with its core car-hailing service. Additionally, advancements in technology, such as autonomous vehicles, could reshape the company’s operational landscape in the coming years.

Conclusion

Uber stock remains a topic of interest, reflecting fundamental shifts in transportation and service delivery. Investors must weigh the volatility and associated risks against potential growth opportunities. With the company actively innovating and responding to market demands, Uber’s stock could continue to fluctuate in the near term, but strategic decisions made today will significantly impact its long-term outlook. For individuals considering investing in Uber, staying informed about market trends and company developments is paramount.