The Importance of Interest Rates in Canada’s Economy

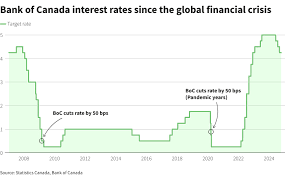

Interest rates play a crucial role in shaping the Canadian economy, influencing everything from consumer spending to business investments. The Bank of Canada, as the country’s central bank, adjusts these rates to ensure economic stability and to counter inflation.

Recent Developments

As of October 2023, the Bank of Canada has maintained its interest rate at 5.0%, a policy stance it has adopted since July of this year. This decision comes amidst growing concerns about inflation, which has shown signs of moderation but remains above the central bank’s target range. The inflation rate in Canada was reported at 3.8% in September 2023, down from over 6% earlier this year. Economists predict that if inflation continues to decrease, the Bank may consider lowering interest rates in the coming months.

Effects on Borrowing and Spending

The high interest rates have made borrowing more expensive for consumers and businesses alike. Mortgage rates have soared, affecting the housing market, which has seen reduced activity, particularly in larger urban centers such as Toronto and Vancouver. According to a report by the Canadian Real Estate Association, home sales fell by 5.4% in August 2023 compared to July during this tightening cycle.

Outlook and Forecasts

Looking ahead, financial analysts are divided on the future trajectory of interest rates in Canada. Some expect rates to remain steady through the end of 2023 if inflation continues to ease, while others speculate that further increases could be required to firmly anchor inflation expectations. The Canadian economy, buoyed by solid job growth and a resilient energy sector, remains sensitive to these changes.

Conclusion

The current interest rate environment in Canada reflects a complex balancing act between controlling inflation and supporting economic growth. For consumers, it’s essential to stay informed about these rates, as they directly affect mortgage payments, loans, and saving rates. Staying aware of potential changes can help individuals make more informed financial decisions. As the situation develops, individuals and businesses alike should keep a close watch on the Bank of Canada’s policy meetings and economic forecasts.