The Importance of the Stock Market in Canada

The stock market serves as a vital component of the Canadian economy, providing opportunities for individuals and institutions to invest, grow wealth, and facilitate capital allocation in various sectors. Understanding the best stock market practices can significantly impact investment success. This article delves into recent trends, strategies, and insights into the best practices for investing in the Canadian stock market.

Recent Trends in the Canadian Stock Market

As of late 2023, the Canadian stock market is showing signs of resilience, rebounding from previous market volatility caused by global economic shifts and local policy changes. The S&P/TSX Composite Index has remained relatively robust, with energy, financial, and technology sectors leading in performance. Reports indicate that investors are increasingly drawn to sectors benefiting from Canada’s green energy initiatives and technological advancements.

Identifying the Best Stocks

Investing in the best stocks requires thorough research and analysis. Fundamental analysis, involving the evaluation of a company’s financial health, industry position, and growth potential, is essential. Potential investors should also consider geopolitical factors, interest rates, and economic indicators that could impact stock performance. Moreover, utilizing tools such as stock screeners and keeping up with financial news and reports can aid investors in making informed decisions.

Diversification as a Key Strategy

Diversification is a fundamental concept in investing that helps manage risk. By spreading investments across various sectors and asset classes, investors can mitigate the impact of poor-performing stocks. The Canadian market offers diverse investment options, from blue-chip companies in the financial sector to emerging tech firms. Diversifying a portfolio is critical, especially amid economic uncertainties.

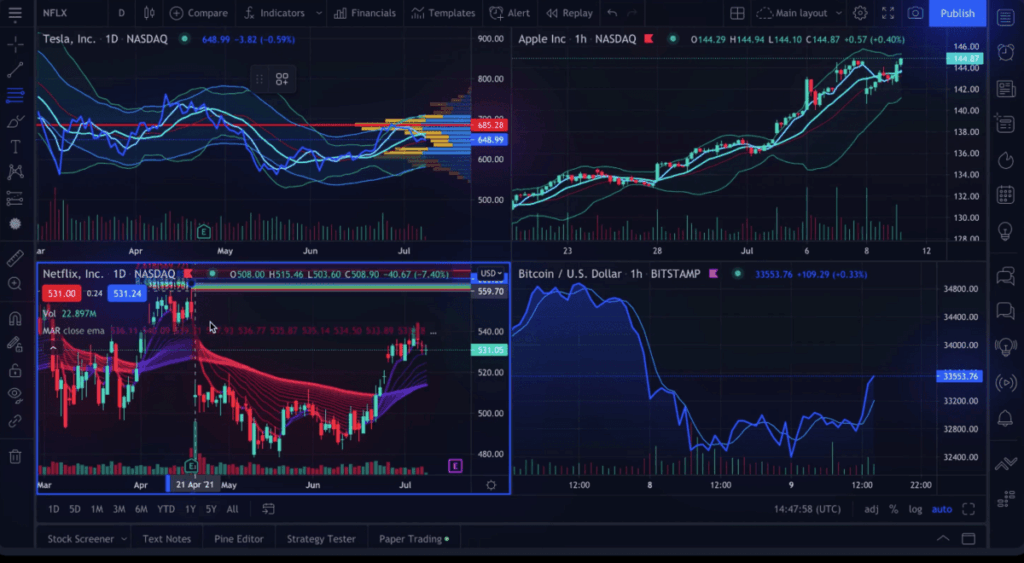

Utilizing Technology in Trading

The rise of fintech has transformed how individuals approach investing in the stock market. Many brokers offer advanced trading platforms equipped with analytical tools that allow for real-time data analysis. Investors are increasingly using robo-advisors and algorithm-driven platforms to optimize their investment strategies, making it easier to enter the market and adjust portfolios according to performance.

Conclusion

As Canadians look towards investing in the best stock market, staying informed and adopting sound investment strategies is paramount. The current market landscape presents both opportunities and challenges, necessitating a proactive approach to stock selection and portfolio management. By following best practices such as extensive research, diversification, and leveraging technology, investors can navigate the Canadian stock market effectively and work towards achieving their financial goals.