Introduction

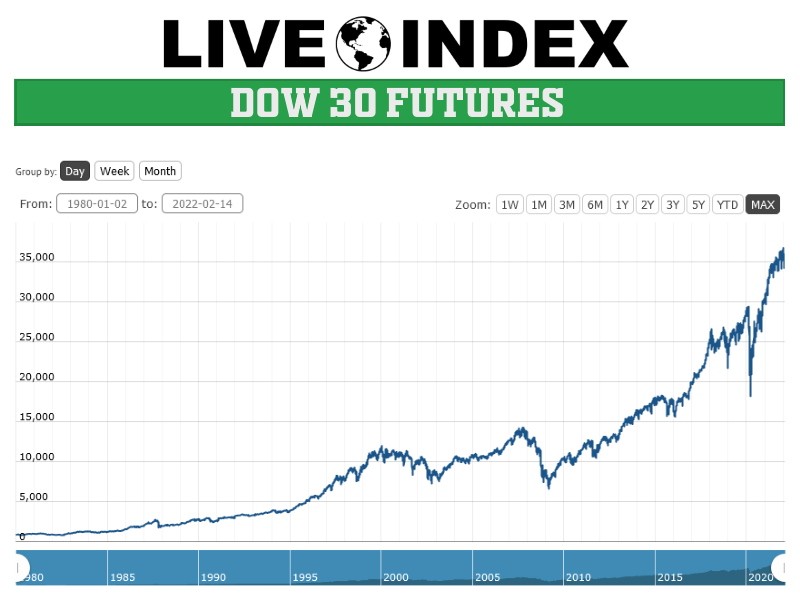

The Dow Jones Industrial Average (DJIA) is a significant benchmark in the financial world, representing the performance of 30 major publicly traded companies in the US. With fluctuations impacting various sectors, understanding the futures of the Dow Jones stock market is increasingly important for investors and economic analysts alike. Futures contracts allow traders to speculate on the future price movements of the DJIA, offering insights into market sentiment.

Current Market Trends

As of late September 2023, futures for the Dow Jones stock markets indicated a mixed outlook. Following a turbulent month marked by inflation concerns and geopolitical tensions, traders are cautiously optimistic. Reports revealed that the DJIA has seen a slight uptick, gaining approximately 2% over the past week, as investor sentiment shifts towards potential interest rate stabilization by the Federal Reserve.

Market analysts suggest that the fluctuating futures are reflective of broader economic indicators. For instance, recent job growth and consumer spending reports have shown resilience despite apprehensions over inflation. As a result, futures for the Dow Jones are hovering around 33,000 points, with many experts predicting a potential testing of resistance levels in the coming months.

Factors Influencing Futures

Several key factors influence the futures of the Dow Jones stock markets:

- Economic Data: Upcoming economic reports are scheduled, including GDP growth and consumer confidence indices, which could sway futures significantly.

- Interest Rate Policies: The Federal Reserve’s stance on interest rates will play a critical role. A potential pause in rate hikes may boost investor morale.

- Global Events: News from international markets, especially regarding trade relations and geopolitical stability, can lead to shifts in Dow futures.

Conclusion

The futures of the Dow Jones stock markets represent a crucial indicator of economic sentiment and potential market trajectory. Investors are advised to remain vigilant and informed as they navigate current market conditions. With the upcoming economic data and Fed meetings looming, volatility is expected in the near term. Observers suggest that understanding the nuances behind these futures could be vital for making sound investment decisions. As the markets continue to evolve, staying updated on economic indicators and corporate performance will remain essential for stakeholders.