Introduction

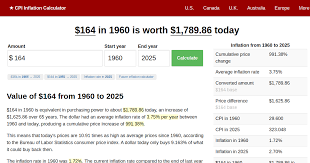

Inflation has become a pressing concern for Canadians as they navigate the economic landscape influenced by various global and local factors. As prices for goods and services continue to rise, understanding the latest inflation trends is essential for consumers, businesses, and policymakers alike. Recent statistics reveal significant shifts in inflation rates, which directly affect buying power, investments, and savings.

Current State of Inflation in Canada

As of September 2023, Canada’s annual inflation rate is reported at 5.6%, according to the Consumer Price Index (CPI) data released by Statistics Canada. This marks a notable increase compared to the previous year, driven largely by fluctuations in energy prices, food costs, and supply chain disruptions. In particular, the energy sector has seen prices surge significantly, with fuel costs rising by approximately 12% over the past year, influenced by geopolitical tensions and changing global oil markets.

Food prices have similarly spiked, partly due to adverse weather conditions affecting agricultural production and ongoing logistical challenges. The rise in basic consumer goods has left many Canadians struggling to keep up with the increasing cost of living, thereby impacting household budgets and overall economic activities.

Responses to Inflation

The Bank of Canada has been actively addressing inflation concerns by adjusting interest rates in an attempt to stabilize the economy. In the latest reports, the central bank raised its benchmark interest rate to 5.0%, the highest level seen in over two decades. The objective behind this move is to curb excessive borrowing and spending, which are key contributors to inflation. However, such measures also raise concerns about potential slowdowns in economic growth and increased mortgage costs for Canadians.

Additionally, the government has introduced various support measures aimed at assisting low- and middle-income families affected by rising prices. These initiatives include direct financial aid and subsidies to critical sectors, which could mitigate the impacts of inflation on vulnerable populations.

Conclusion

The latest inflation trends in Canada highlight a complex interplay of global economic factors and domestic policies. With rates projected to remain elevated in the near future, it is crucial for households to adapt by reassessing their financial plans and budgets. Furthermore, continuous monitoring of inflation rates will be essential for policymakers to ensure that effective measures are in place to protect consumers and promote stable economic growth. As Canadians face these economic challenges, staying informed about inflation will empower individuals to make better financial decisions in uncertain times.