Introduction

The Toronto-Dominion Bank (TD) and the Bank of Nova Scotia (Scotiabank) are two of Canada’s largest financial institutions, with the latter’s stock—known as BNS stock—drawing considerable attention from investors. The performance of BNS stock is vital not only to stockholders but also provides insight into the broader economic conditions in Canada and beyond. Amid recent interest rate changes and shifts in global banking trends, the behavior of BNS stock serves as an essential barometer for investors.

Recent Market Developments

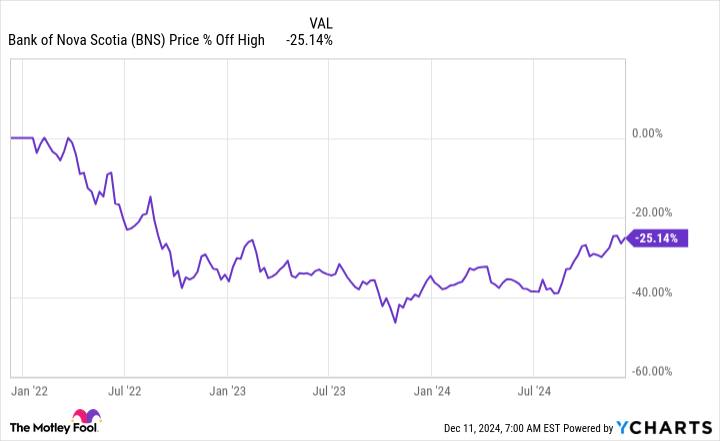

As of October 2023, BNS stock has seen fluctuations primarily influenced by the Bank of Canada’s decision to hold interest rates steady. This decision is rooted in an effort to manage inflation while fostering economic growth, impacting banks like Scotiabank that rely on lending activity for the majority of their revenue.

Recent reports indicate that BNS stock has traded around CAD 70, which represents a rise of approximately 5% over the past quarter. Analysts note that the bank’s robust mortgage portfolio and an increase in commercial lending are key drivers of this growth.

Financial Performance and Forecasts

Scotiabank released its Q3 earnings report earlier this month, showcasing a net income of CAD 2.45 billion, a year-over-year increase of 8%. This reflects the bank’s ability to navigate a complex economic landscape effectively. Analysts project a continued upward trend for BNS stock, with a target price set at CAD 75 over the next 12 months, given its commitment to technological investments and enhancing customer experience.

Challenges Ahead

Despite the positive outlook, challenges loom for BNS stock in the form of increasing competition from fintech companies and potential economic slowdowns. Analysts caution that while the Canadian economy shows resilience, a global recession or significant market corrections could affect bank profitability negatively. Investors are advised to monitor international economic indicators closely, as these can significantly impact stock performance.

Conclusion

BNS stock remains a particularly attractive investment option within Canada’s banking sector, supported by solid financial performance and growth prospects. However, potential investors should remain vigilant about broader economic indicators and competition in the financial industry. With recent trends leaning positively for Scotiabank, BNS stock could be poised for further growth, making it worth considering for those looking to diversify their investment portfolio in the financial sector.