Introduction to Gold Prices in India

The price of gold in India holds significant relevance for the economy, culture, and individual investments. As one of the largest consumers of gold worldwide, India constantly feels the effects of global market fluctuations, currency changes, and local demand drivers. Tracking these prices is essential for investors, jewelers, and everyday consumers alike, particularly as the wedding season approaches, which traditionally boosts demand.

Current Trends in Gold Prices

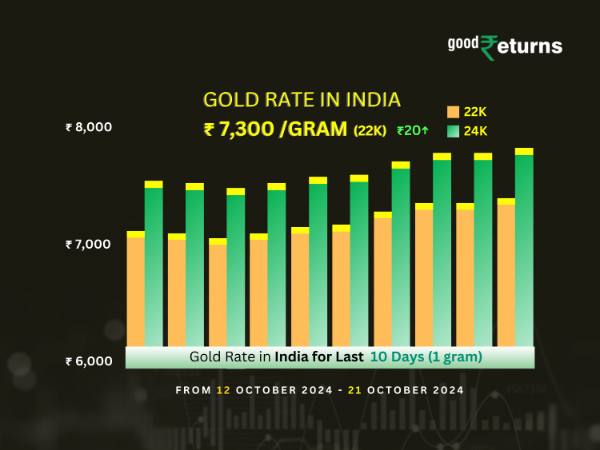

As of early October 2023, the gold price in India has seen a notable increase, currently hovering around INR 61,500 per 10 grams. This rise can be attributed to several global factors, including heightened economic uncertainty due to geopolitical tensions and inflationary pressures. Gold often acts as a safe-haven asset during volatile times, leading to increased investments.

Influence of Global Markets

International factors play a pivotal role in determining the gold price in India. For instance, the strong US dollar, which typically inversely affects gold prices, has sparked investor interest. Additionally, the recent Federal Reserve interest rate decisions may induce fluctuations in the gold price as they influence inflation expectations and currency strength. Recent data indicate that global gold demand remains resilient, particularly from central banks in various countries, further contributing to India’s pricing trends.

Local Demand and Festivities

The domestic market’s unique elements significantly influence gold prices in India as well. Festive seasons and weddings traditionally see spikes in demand. The upcoming Diwali festivities often lead to increased buying, contributing to price increases ahead of the season. In 2023, jewelers are anticipating higher sales as consumers turn to gold for investments and heirloom pieces.

Conclusion and Future Outlook

In conclusion, the gold price in India is intricately linked to global economic indicators and local buying patterns. With current prices reflecting both international events and the domestic festive season, we expect continued volatility in the upcoming months. Potential buyers should consider market indicators and monitor prices closely, especially as we approach significant buying periods. Understanding the ongoing interplay between these factors will be crucial for making informed decisions, whether for investment or consumption.