Introduction

Enbridge Inc., a Canadian multinational energy transportation company, has a prominent role in North America’s energy infrastructure. With pipelines spanning from coast to coast, the company’s stock performance is closely watched by investors and analysts alike. As the energy market continues to evolve—shaped by factors such as regulatory changes, energy prices, and shifts towards renewable energy—understanding the current state of Enbridge stock has become increasingly significant for those interested in the energy sector.

Recent Performance and Market Trends

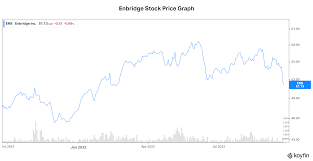

As of October 2023, Enbridge’s stock price has seen fluctuations influenced by various market conditions. After a challenging period marked by geopolitical tensions and fluctuations in oil prices, the stock has exhibited resilience in recent months. Enbridge aims to transition more towards renewable power sources, which is in line with global trends favoring sustainability. According to financial analysts, Enbridge’s shift towards investing in renewable energy projects, including wind and solar, has garnered positive attention and is expected to contribute to its long-term growth.

In terms of financial performance, the company’s latest earnings report revealed a solid revenue increase of 10% compared to the previous quarter. This growth was largely driven by higher demand for oil and natural gas transportation as global economies continue to recover post-pandemic. Additionally, Enbridge declared a quarterly dividend of $0.87, reflecting a commitment to providing returns to its shareholders amidst market uncertainties.

Factors Influencing Future Stock Movement

The future of Enbridge’s stock is likely to be influenced by several key factors. Firstly, ongoing regulatory decisions in Canada and the U.S. can have significant implications on the company’s pipeline projects and overall operational costs. Recent government proposals aimed at reducing carbon emissions could necessitate further investments from Enbridge into green technologies.

Moreover, the global shift toward cleaner energy practices poses both opportunities and challenges. With increasing investments in renewable resources, Enbridge has announced its goal to achieve net-zero greenhouse gas emissions by 2050. Analysts believe that this pivot towards green energy could bolster investor confidence in the stock as it aligns with environmentally-conscious investment strategies.

Conclusion

For investors, Enbridge stock represents both a stable dividend-paying opportunity and exposure to the ongoing energy transition. Despite facing headwinds due to market volatility and regulatory changes, the company’s strategies aimed at enhancing its renewable energy portfolio position it favorably for long-term growth. As energy dynamics continue to evolve, stakeholders will need to monitor the performance and strategic decisions of Enbridge closely, ensuring they remain informed on how these factors affect stock potential. Overall, Enbridge stock is poised to be an important focal point in the broader discussion about energy investment in the coming years.