Introduction

Telus Corporation, one of Canada’s leading telecommunications companies, has seen its stock performance under scrutiny lately. With the volatility of the global economy and increasing competition in the telecom sector, understanding the trends and factors influencing Telus stock is essential for investors and stakeholders alike. This article will delve into recent developments, performance metrics, and market sentiments surrounding Telus stock.

Recent Performance

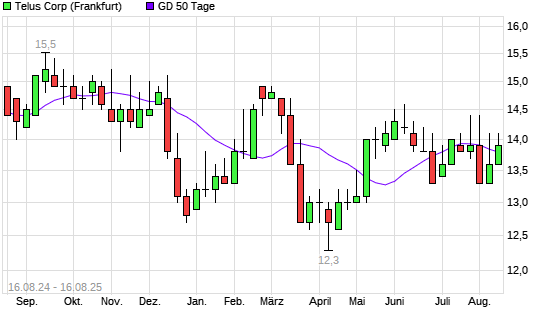

As of late October 2023, Telus stock (TSE: T) has shown a mixed performance in the market. In the past year, the shares have fluctuated between $23 and $30, largely influenced by changes in interest rates and consumer demand. Analysts noted a growth trend early in 2023 as the company exceeded quarterly earnings expectations, but profits have dampened slightly as operational costs rise and fierce competition from Rogers and BCE continues to challenge Telus’s market share.

Factors Influencing Telus Stock

Market Competition

The Canadian telecommunications industry remains highly competitive with key players like Bell and Rogers also aggressively targeting mobile and internet subscribers. New offerings and promotional discounts have tugged at customer loyalties, pressuring Telus to enhance its service value propositions.

Financial Metrics

Telus reported a revenue growth of 5% year-over-year in Q2 2023, primarily driven by its wireless segment. However, the rising costs of equipment and network infrastructure due to advancements in 5G technologies have added pressure to maintain margins. Employment costs have also risen, with Telus increasing its workforce to support expansion into digital health solutions.

Future Outlook

Looking forward, industry analysts remain cautiously optimistic about Telus stock. The company’s ongoing investment in network expansion and diversification into health services are anticipated to create new revenue streams. Projections suggest that if Telus can effectively leverage its investments and navigate market challenges, it may stabilize its stock within the $25-$28 range through 2024.

Conclusion

While Telus stock faces headwinds from market competition and rising operational costs, its ability to innovate and diversify remains a key area for potential growth. For investors, keeping abreast of market trends and Telus’s strategic directions will be crucial. As the telecom landscape continues to evolve, the outlook for Telus could provide lucrative opportunities, provided it adapts effectively to the changing dynamics.