Introduction

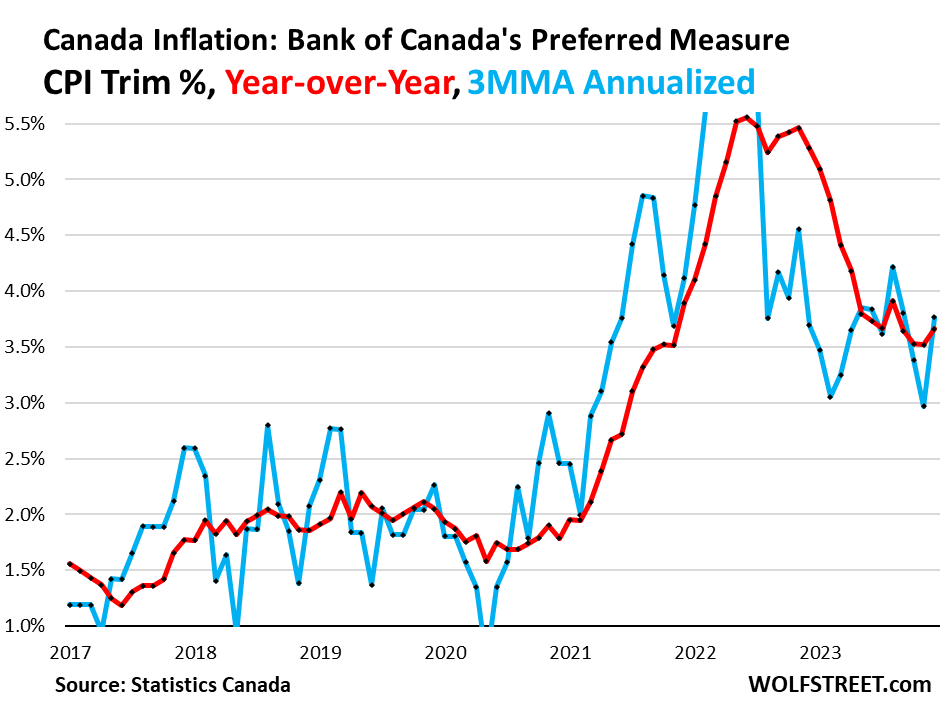

The inflation rate is a critical economic indicator that measures the rate at which the general level of prices for goods and services is rising. In Canada, understanding inflation is particularly important as it influences everything from consumer purchasing power to the nation’s monetary policy. Recently, Canada has experienced notable shifts in its inflation rate, making this a pressing topic for citizens and policymakers alike.

Current Trends in Inflation

As of October 2023, Canada’s inflation rate stands at approximately 3.4%, a decrease from the highs observed in 2022, which saw rates peak around 8.1%. The Bank of Canada and government officials attribute this decline to various factors, including easing supply chain disruptions and stabilizing energy prices. However, despite this decline, inflation remains a concern as it surpasses the Bank of Canada’s target inflation rate of 2%.

Impact on Consumers

The rising inflation rate has directly impacted Canadian households. The cost of groceries has seen substantial increases, with the food index rising by 5.6% year-over-year as of September 2023. Housing costs are another significant factor contributing to inflation, especially in urban areas where rents and home prices remain high. This situation has prompted many Canadians to reassess their budgets and spending habits.

Bank of Canada’s Response

To combat high inflation, the Bank of Canada adopted a more aggressive monetary policy throughout 2022 and early 2023, raising interest rates multiple times to discourage spending and borrowing. Recent announcements indicate a pause in these rate hikes as officials monitor how the economy reacts to previous measures. Andrew Poloz, former Governor of the Bank of Canada, noted, “Controlling inflation is crucial for maintaining economic stability, and the path forward may include balancing growth and inflation control strategies moving into 2024.”

Conclusion

As we approach the end of 2023, the inflation rate in Canada remains a pivotal issue affecting various sectors of the economy and everyday Canadians. While the recent decline in inflation gives some hope, the continued elevated levels signal that challenges remain ahead. Consumers, businesses, and policymakers will need to work together in navigating these fluctuating economic conditions. Looking forward, the forecast indicates that inflation may stabilize but may take some time to return to the ideal target, necessitating ongoing vigilance from all stakeholders in the economy.