Introduction

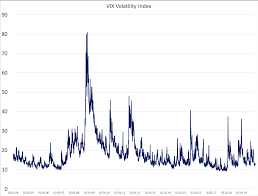

The Volatility Index, commonly known as the VIX, is a critical gauge of market sentiment and volatility. Often referred to as the “fear index,” the VIX serves as an essential tool for investors and traders alike. Understanding the VIX is particularly relevant in today’s fast-paced financial environment, where market fluctuations are more pronounced and sentiments can shift rapidly.

What is the VIX?

Calculated by the Chicago Board Options Exchange (CBOE), the VIX measures the market’s expectations of volatility over the next 30 days. It is derived from the implied volatility of options on the S&P 500 index (SPX), making it a popular indicator of short-term market risk. A rising VIX value typically indicates increased volatility and, often, market uncertainty.

Current Trends and Events

As of October 2023, the VIX has been exhibiting significant fluctuations due to ongoing economic concerns, including interest rate changes, inflation data, and global geopolitical tensions. For instance, recent announcements from the Federal Reserve regarding interest rate hikes have contributed to heightened market volatility, reflected in a spike in VIX values. Investors are closely monitoring this index as it provides insights into future market movements and potential downturns.

In the last month, the VIX saw a notable increase, rising from a value of around 18 to over 24, indicating a shift towards a more fearful market sentiment. This increase aligns with bearish market trends, where stock prices are expected to decline. Analysts suggest that this rise may indicate that investors are bracing for possible downturns.

Significance for Investors

For investors, the VIX serves as a tool for managing risk. Strategies involving the VIX, such as protective puts or options trading, can help investors hedge against market falls. Understanding the VIX can also help in timing purchases or sales of equities based on perceived market risk. For example, higher VIX levels often signal a good time for defensive investment strategies, whereas lower levels might present buying opportunities in bullish markets.

Conclusion

The VIX remains an indispensable index for understanding market dynamics and volatility. With recent fluctuations in its value, it serves as a warning signal for potential market risks ahead. Investors are encouraged to remain vigilant and consider the VIX in their financial strategies, as it can provide valuable insights into market trends and the overall economic climate.