Introduction

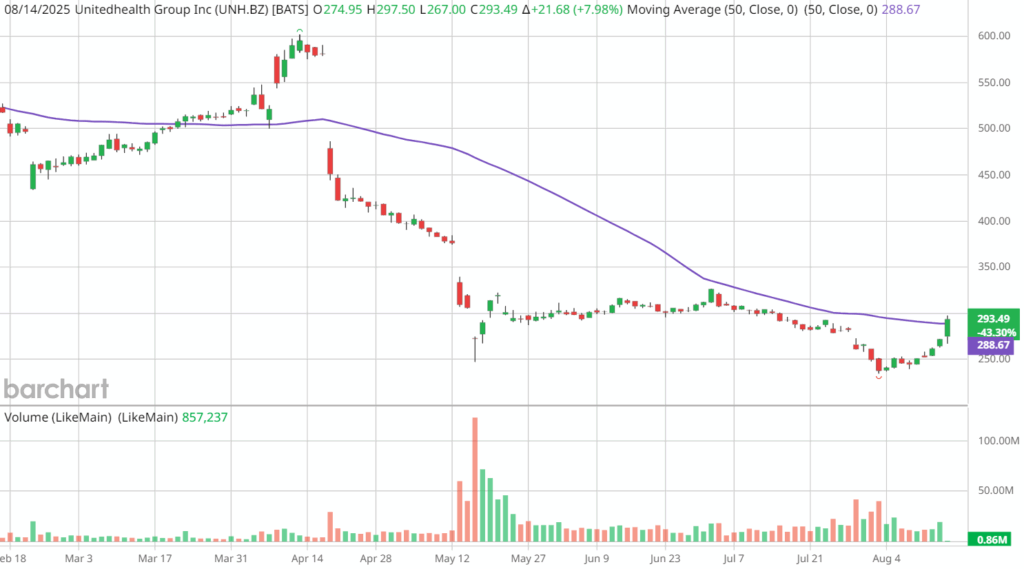

The stock performance of UnitedHealth Group Incorporated (UNH), one of the largest healthcare companies in the world, is of significant importance to investors and analysts alike. As healthcare becomes an increasingly critical component of the economy, understanding the dynamics affecting UNH stock is essential for making informed investment decisions. Recently, UNH stock has exhibited considerable movements, reflecting broader market conditions and company-specific developments.

Current Market Performance

As of October 2023, UNH stock has shown resilience despite economic headwinds. The stock is trading consistently above $500 per share, a level it has maintained throughout a volatile year characterized by fluctuating interest rates and ongoing healthcare policy debates. The company’s ability to navigate these challenges reflects its solid business model and strategic initiatives in healthcare services and technology integration.

In the last quarter, UnitedHealth reported a revenue growth of 10% compared to the previous year, driven primarily by an increase in membership across its insurance plans and the expansion of its Optum Health services. Analysts anticipate continued growth in the coming quarters as the aging population drives demand for healthcare services.

Analyst Insights and Forecasts

Analysts have weighed in on UNH’s potential moving forward. According to a recent report from investment firm Jefferies, UNH stock could see an upward trajectory, with price targets set around $600 within the next 12 months, citing the company’s strong fundamentals and market positioning. However, some analysts express caution over potential regulatory changes that could impact pricing and competition in the healthcare sector.

Additionally, the integration of artificial intelligence in healthcare management presents opportunities for UnitedHealth to enhance operational efficiencies and patient care offerings. The utilization of such innovative technologies positions the company favorably for long-term growth.

Conclusion

In conclusion, UNH stock remains a significant player in the stock market, reflecting the health of the broader healthcare industry. With ongoing positive performance metrics and strategic growth initiatives, investors are closely watching how UnitedHealth adapts to market challenges and regulatory changes. As healthcare continues to evolve, the prospects for UNH stock look promising, but investors should remain vigilant and informed about sector trends and potential risks. The insights shared by analysts will be crucial in navigating the investment landscape associated with UNH.