Introduction

Suncor Energy Inc., a prominent player in the Canadian oil and gas sector, has been attracting significant attention from investors recently. The company’s stock performance has garnered interest due to fluctuations in global oil prices, the push for renewable energy, and economic recovery following the pandemic. Understanding the factors impacting Suncor stock is crucial for investors looking to make informed decisions in today’s volatile market.

Recent Performance

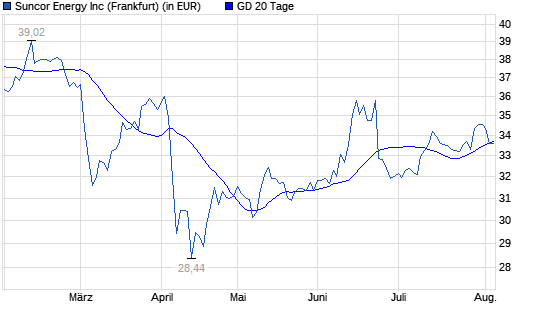

As of October 2023, Suncor’s stock has experienced a notable recovery from the lows seen during the early days of the COVID-19 pandemic. After hitting prices in the low $10 range in 2020, the stock has rallied significantly, closing around $40 in recent trading sessions. Analysts attribute this rebound primarily to the rising global demand for oil as economies reopen, coupled with supply chain adjustments.

However, Suncor’s stock is not without its challenges. Rising interest rates and global economic uncertainties may dampen investor sentiment. Recent earnings reports indicate that while Suncor has reported higher revenues and profits, concerns over capital spending and the transition to green energy sources remain prevalent among investors.

Investors’ Sentiment and Market Trends

Investor sentiment surrounding Suncor has been mixed. While the company continues to generate solid profits, there is a growing emphasis on sustainability in the energy sector. Suncor has announced initiatives to improve its emissions targets, which are vital for long-term operational viability as global oil demand peaks. The company’s efforts in renewable energy investments and carbon capture technologies signal its commitment towards a sustainable future.

Market analysts predict that Suncor’s stock could see further fluctuations in the short term due to ongoing geopolitical tensions in oil-producing regions and shifts in energy policy. However, the company’s profitability and commitment to shareholder returns through dividends may provide a buffer during market corrections.

Conclusion

For investors tracking Suncor stock, staying informed about the company’s operational strategies and external market factors is paramount. With the ongoing energy transition and fluctuating oil prices, Suncor’s strategic moves towards sustainability and profitability will play crucial roles in determining its stock performance in the months to come. As the energy landscape evolves, Suncor must adapt to maintain its position as a leading player in the sector while navigating the complexities of investor expectations.