Introduction

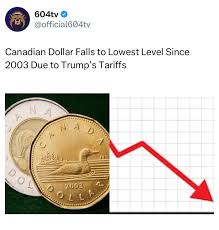

The Canadian dollar, a key indicator of the nation’s economic health, has been experiencing a notable decline in recent months. This trend has significant implications for Canadians, affecting everything from purchasing power to the cost of imported goods and travel abroad. Understanding the reasons behind this downturn and its consequential effects on the economy is essential for both consumers and businesses alike.

Current Economic Context

As of October 2023, the value of the Canadian dollar has weakened against major currencies, including the US dollar. Economic data shows that the CAD has dropped over 6% since the start of the year, trading at approximately 0.73 USD. This depreciation can be attributed to several factors, including fluctuating oil prices, inflationary pressures, and shifts in global market sentiment.

Impact of Oil Prices

Canada is heavily reliant on its oil exports, with oil serving as a substantial component of the national economy. Recent declines in global oil prices, driven by reduced demand and geopolitical uncertainties, have directly impacted the strength of the Canadian dollar. As oil prices fall, Canada’s trade balance suffers, leading to a weaker currency.

Inflationary Pressures

Moreover, Canada has been grappling with elevated inflation rates, which rose to 5.7% in September 2023. The higher cost of living influences consumer confidence and spending habits, while also prompting the Bank of Canada to consider tightening monetary policy. However, increased interest rates can lead to slower economic growth, causing investors to seek stability elsewhere, further exacerbating the dollar’s decline.

Global Factors

Global economic shifts also play a role; as the US Federal Reserve continues to raise interest rates to combat inflation, the Canadian dollar often weakens against the USD. Investors tend to favor the stronger returns associated with American assets amid uncertainties in the Canadian financial landscape. Additionally, geopolitical tensions and trade policies can lead to volatility in currency markets, impacting the CAD’s performance.

Conclusion

The present decline of the Canadian dollar carries significant ramifications for Canadians. Imported goods are likely to become more expensive, directly affecting consumers’ wallets. Travelers seeking to visit the United States or other countries may find their spending power diminished. Looking ahead, economists predict that the Canadian dollar’s fate will largely depend on the stability of oil prices, inflation management, and global economic conditions. As such, Canadians should remain informed and prepared for the potential changes in their economic environment.