Introduction

CoreWeave, a leading cloud service provider specializing in GPU-accelerated computing, has been making waves in the technology and investment communities. As businesses increasingly pivot to cloud solutions, CoreWeave’s stock has garnered attention for its remarkable growth potential. Understanding the trends, performance, and implications of CoreWeave stock is crucial for investors looking to capitalize on the burgeoning cloud computing market.

Recent Developments

In the past year, CoreWeave has reported impressive revenue growth, reflecting a significant increase in demand for its services, particularly among AI and machine learning companies. Recently, the company announced a strategic partnership with a major player in the AI space, which is expected to drive further growth. This collaboration aims to leverage CoreWeave’s advanced cloud infrastructure to enhance scalability and speed for AI workloads, ultimately positioning the company as a frontrunner in high-performance cloud computing.

Stock Performance

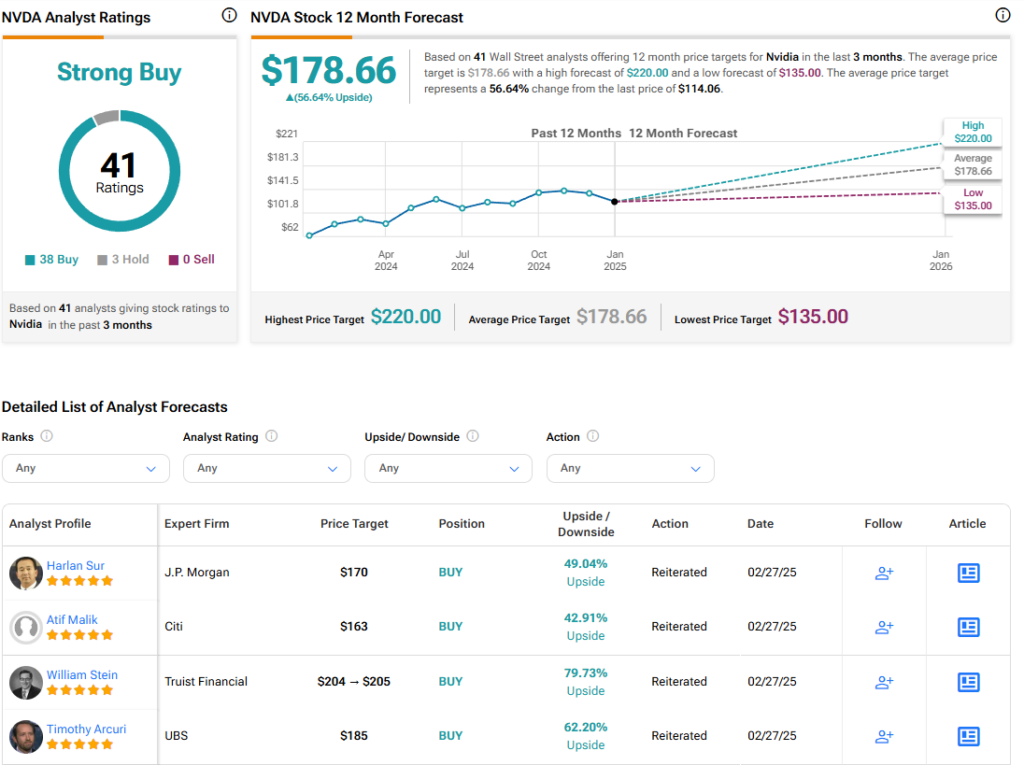

CoreWeave’s stock, traded on the Nasdaq, has shown promising performance since its IPO earlier this year. Analysts have noted a strong upward trend, attributed to the global shift towards digital transformation and increased adoption of AI technologies. The stock’s price has enjoyed a healthy rally, with market analysts projecting a bullish outlook based on current earnings reports and future forecasts. However, investors are advised to consider market volatility and conduct thorough due diligence before making investment decisions.

Market Trends and Forecasts

As cloud computing continues to evolve, CoreWeave stands to benefit from several key market trends. The increasing demand for computing power driven by advancements in AI and big data analytics is likely to bolster the company’s service offerings. Furthermore, the rise in remote work and digital services is expected to sustain demand for scalable cloud solutions. Analysts are optimistic that CoreWeave will continue to innovate and adapt in this competitive landscape, which may translate to continued growth in stock value.

Conclusion

In summary, investing in CoreWeave stock offers a glimpse into the future of cloud computing and associated technologies. As businesses expand their digital capabilities, CoreWeave’s unique positioning in the market and strategic partnerships could play a crucial role in its growth trajectory. Investors should keep an eye on CoreWeave’s performance, market conditions, and industry trends, as these factors will influence the stock’s valuation and investment potential in the coming months. The evolution of CoreWeave represents an intriguing opportunity in a rapidly transforming technological landscape.