Introduction

In 2023, UPS stock has become a topic of significant interest among investors as the logistics and delivery sector continues to evolve. The performance of UPS, one of the largest parcel delivery services in the world, can provide insights into overall market trends as well as consumer behavior. With e-commerce growth and increasing demand for delivery services, tracking UPS stock is critical for both investors and analysts.

Recent Performance

As of October 2023, UPS stock (NYSE: UPS) has exhibited fluctuating performances due to various external factors, including inflation and changes in supply chain dynamics. The stock closed at approximately $160 per share as of the most recent trading session, slightly down from its peak earlier in the year. Analysts report that while the global economy is stabilizing post-pandemic, uncertainties still loom regarding continued operational costs and service demand.

Market Reactions

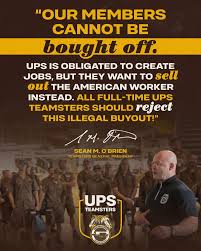

In July 2023, UPS reported its second-quarter earnings, which beat analysts’ expectations. Revenue increased by 5% year-over-year, driven by strong e-commerce deliveries and expanded international services. However, despite positive earnings, the stock saw fluctuations due to rising fuel costs and labor negotiations. In September 2023, the announcement of a new union contract for UPS workers resulted in a brief rally in stock prices, as investors gained confidence in the stability of operations moving forward.

Future Outlook

Experts remain cautiously optimistic about UPS stock’s trajectory heading into 2024. Factors such as continued growth in e-commerce, the company’s strategic investments in technology, and improvements in operational efficiencies are likely to bolster UPS stock. However, potential risks also exist, including labor disputes and geopolitical factors impacting trade. Analysts predict that maintaining competitive delivery rates and investing in sustainable logistics will be crucial for UPS to retain its market position and enhance shareholder value.

Conclusion

In summary, UPS stock remains a focal point for investors looking to capitalize on the evolving logistics sector. As the company navigates a complex landscape of economic pressures and market demands, its performance will be closely monitored. With a solid foundation and strategic initiatives in place, UPS could see substantial growth opportunities in the coming years. Staying informed about developments related to UPS stock will be beneficial for investors aiming to navigate these exciting yet challenging times in the logistics industry.