Introduction

Uber Technologies, Inc. has been a significant player in the ride-hailing and food delivery industries since its inception in 2009. As the world emerges from the pandemic, Uber stock has become a focal point for investors and analysts alike. With shifting market dynamics and the ongoing recovery of consumer demand in the travel and leisure sectors, understanding Uber’s stock performance is critical for potential investors.

Current Performance and Market Trends

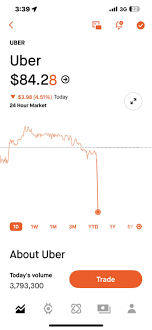

As of October 2023, Uber’s stock price has demonstrated notable volatility. Following a decrease in market confidence in early 2023, where shares dipped below $30, the stock has surged back, climbing to around $41 per share, reflecting a trend of recovery. Analysts attribute this rebound to a combination of improved regulatory environments, operational efficiencies, and the growing profitability within its food delivery segment, Uber Eats.

Recent reports indicate that Uber’s revenue increased by 29% in the second quarter of 2023 compared to the previous year, signaling strong demand for its services. Investor interest has also been stirred by Uber’s efforts to expand into new markets and diversify its offerings beyond ride-hailing and food delivery.

Future Outlook

Experts predict a cautiously optimistic outlook for Uber stock. With the company introducing new features, such as subscription services for riders and delivery options, there is potential for revenue growth. Moreover, ongoing investments in autonomous vehicle technology may provide a competitive edge in the long term.

However, challenges persist, including regulatory scrutiny in various markets and competition from other ride-sharing services. Analysts urge investors to weigh these risks against the potential for growth as the company adapts to an evolving market landscape.

Conclusion

In conclusion, Uber stock remains a topic of interest as the company navigates a post-pandemic landscape filled with both challenges and opportunities. With a focus on revenue growth and technological advancements, Uber presents a compelling case for investors looking to tap into the future of transportation and logistics. However, it’s essential to remain vigilant about market changes and regulatory developments that could impact stock performance in the coming months.