Introduction

As one of Canada’s largest airlines, Air Canada plays a pivotal role in the national economy. The performance of Air Canada stock is closely watched by investors, analysts, and everyday Canadians alike. With the airline industry undergoing significant transformations following the pandemic, understanding the current status of Air Canada’s stock is crucial for potential investors and stakeholders.

Recent Developments

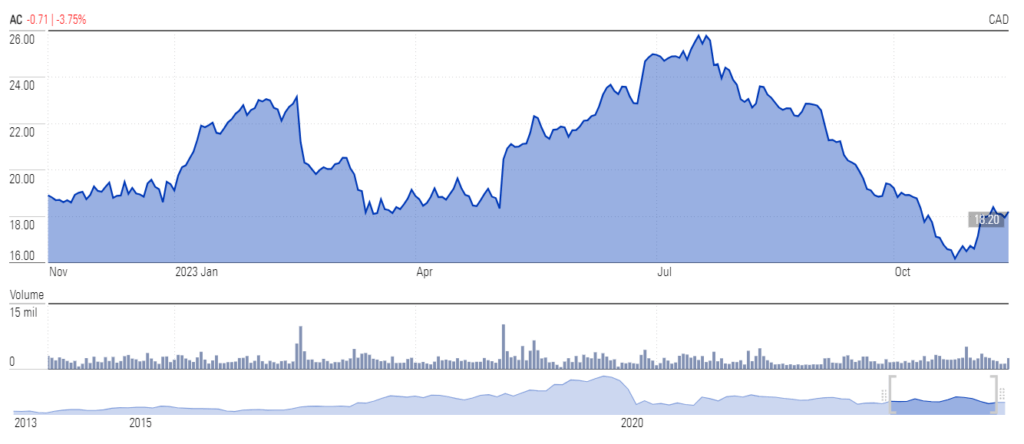

In recent months, Air Canada has experienced fluctuations in its stock price, reflecting both operational challenges and recovery trends. As of October 2023, Air Canada stock trades at approximately CAD $25.50, having seen a rise of over 20% since the start of the year. The airline has successfully navigated increased travel demand as restrictions have eased, leading to a roaring recovery in air travel for leisure and business purposes.

Analysts suggest that the rise in stock prices is associated with various factors including a resurgence in travel demand, successful efforts to streamline operations, and cost reductions following restructuring efforts initiated during the COVID-19 pandemic. For example, Air Canada reported a net income of CAD $400 million in Q2 2023, which demonstrates strong performance compared to the same period in the previous year.

Future Outlook

Looking ahead, several analysts are optimistic about the potential for Air Canada stock as international travel restrictions continue to ease and new markets are opened up. However, challenges such as fuel prices, labor shortages, and competition from low-cost airlines remain key risks. According to a report by the International Air Transport Association (IATA), air travel demand is expected to continue to grow over the next few years, which bodes well for established players like Air Canada.

Moreover, as governments invest in infrastructure and bolster their commitment to enhancing public health, Air Canada could benefit from improved operational efficiencies and customer confidence in the airline sector.

Conclusion

The importance of monitoring the performance and market trends related to Air Canada stock cannot be overstated for investors and industry watchers. As travel demand rebounds and the global economy stabilizes, investors may find promising opportunities in Air Canada stock. However, it remains essential to stay informed about potential risks and challenges that could impact the airline’s profitability and stock performance moving forward.